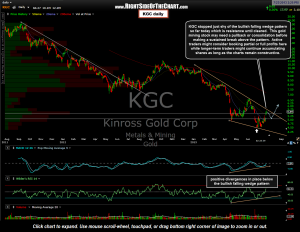

KGC is another of the 10 favorite mining stocks posted on June 26th. KGC has made about a 25% run since then to kiss the top of bullish falling wedge pattern (i.e.- the uppermost downtrend line), which has naturally acted as resistance so far. Based on where prices are relative to the apex of the wedge, it looks as though KGC might need a some additional consolidation within the pattern before building the energy to make a sustained breakout to the upside.

KGC is another of the 10 favorite mining stocks posted on June 26th. KGC has made about a 25% run since then to kiss the top of bullish falling wedge pattern (i.e.- the uppermost downtrend line), which has naturally acted as resistance so far. Based on where prices are relative to the apex of the wedge, it looks as though KGC might need a some additional consolidation within the pattern before building the energy to make a sustained breakout to the upside.

Of course if prices were to break above the pattern soon that would technically be a bullish event. However, with the stock so extended in the short-term, any breakout this week might be prone to fail rather quickly, maybe even backtesting pattern at a considerably lower level over the next few weeks. Therefore, this is another one of the mining stocks which I am more apt to book profits on at this point than to hold or add to if prices continue higher. Just to be clear, this pattern still looks bullish for longer-term traders or investors at this time. Those viewing the miners as potential long-term trades here might continue to scale in to the stock as long as the daily & weekly charts remain constructive.