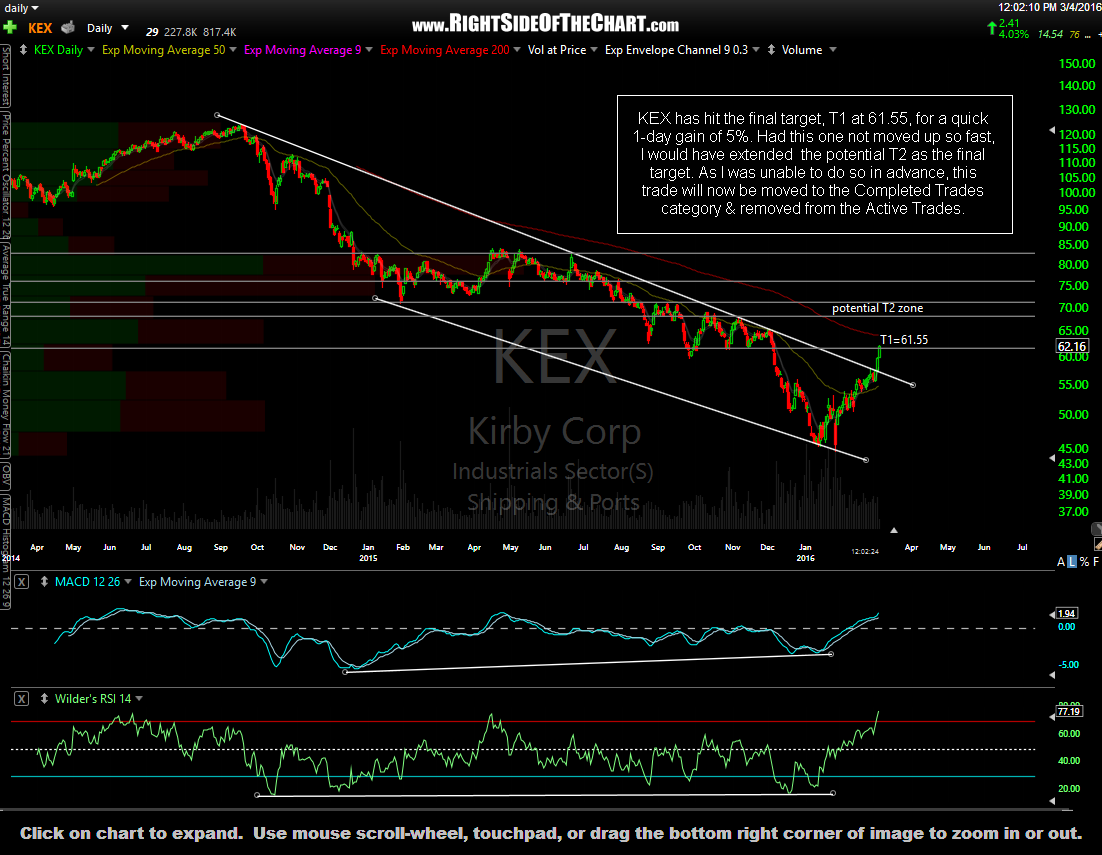

KEX has hit the final target, T1 at 61.55, for a quick 1-day gain of 5%. Had this one not moved up so fast, I would have extended the potential T2 as the final target. As I was unable to do so in advance, this trade will now be moved to the Completed Trades category & removed from the Active Trades.

For those who have not had an opportunity to check out the new Trading Room yet, full access to the site will remain open to all free of charge through the end of March. The trading room is a forum for traders & investors of various experience levels, backgrounds and trading styles to share & discuss market commentary and trade ideas. The trading room also allows me to post numerous “unofficial” trade ideas which are those that don’t make the front page of the site (note: official trade ideas will be reversed for registered users of the site going forward while select market analysis and commentary will remain accessible to the public without requiring registration on RSOTC). Additional details to follow on the subscription service soon.

KEX, along with the NAT Active Long Trade as shipping stocks. One example of unofficial trade ideas was this list of potentially explosive trade setups posted in the trading room yesterday:

Right Side Of The Chart posted an update in the group ![]() Swing Trading 23 hours, 42 minutes ago

Swing Trading 23 hours, 42 minutes ago

Some other shipper poised to explode, should the broad market continue higher (a big IF):

NMM over 1.25

DSX over 2.80

NM a break over 0.97 could bring it to 1.14

GOGL (several levels, best when I get a minute to post a chart)

PRGN next move over 3.75

KEX already posted as an official trade idea today

SSW backtesting the 17.41 R it took out earlier today, if backtest hold, next stop 18.00

TNK best to wait for a continued move down to 3.40-3.30 key support zone, trading at 3.68 now

STNG nice IHS on daily chart, entry to come on a break above the up-sloping neckline

EGLE over 0.81

As you can see from the screenshot of my shipping stock watchlist, most if not all of those breakouts went on to trigger today, resulting in 1-day gains of ranging as high as 75%:

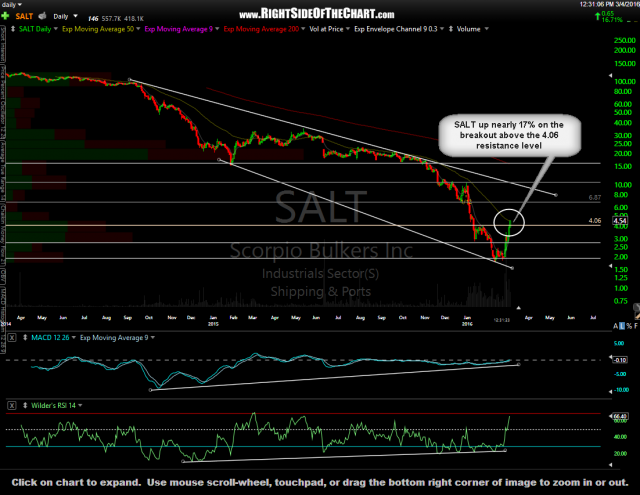

As well as this setup for a long trade in another shippper, SALT:

Right Side Of The Chart posted an update in the group ![]() Swing Trading 1 day ago

Swing Trading 1 day ago

SALT could easily run up to the 6.90ish level if it takes out 4.06 and the trend in the market & shipping sector remains bullish at that time. This isn’t an official trade idea, at least not at this time but I did want to pass it along for those interested.

Over the years, it had been my experience that once the momentum players step in to play, there is only one sector that can produce even larger gains, or losses, in such short as the gold mining stocks; the shippers. If I had to rank the top 3 sectors by volatility/gain potential (in descending order stating with that prone to the largest price gains & losses in the shortest period of time), it would be:

1) The shipping stocks

2) Gold/silver mining stocks

3) Biotech stocks

Although its too early to say if this is the start of a much larger trend, the shippers have started to catch a bid recently with this “risk on” market driving the momentum players & bottom pickers into all things left for dead (first gold stocks, then energy and now shippers?)

Remember, with the added profit potential comes increased potential for swift & powerful losses. Risk & return go hand in hand. As such, beta-adjusting your position size if trading the shippers is critical IMO. Not only that, this whole “risk on” trade feels like a game of musical chairs. These low-priced, high-beta trades like CHK work great…until the music stops & the momo traders scurry like roaches when the lights turn on.

- SALT daily March 3rd

- SALT daily March 4th