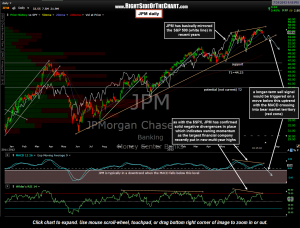

As this daily clearly illustrates, JPM has traded in near lockstep with the S&P 500 in recent years. Current, as with the $SPX, the recent breakout to new multi-year highs has some red flags that could spell trouble ahead for the largest financial institution in the country (as well as one of the top ten components of the $SPX). The last short trade on JPM was stopped out for a loss but JPM will be added back as a Short Setup with an entry to be triggered on a break below this primary uptrend line.

As this daily clearly illustrates, JPM has traded in near lockstep with the S&P 500 in recent years. Current, as with the $SPX, the recent breakout to new multi-year highs has some red flags that could spell trouble ahead for the largest financial institution in the country (as well as one of the top ten components of the $SPX). The last short trade on JPM was stopped out for a loss but JPM will be added back as a Short Setup with an entry to be triggered on a break below this primary uptrend line.

Aggressive traders could establish an initial position here with the intention of adding on an official breakdown. However, with the market still in buy the dip mode until proven otherwise, as well as most trend indicators still bullish for now, my preference is to hold off for some additional evidence of a trend reversal in the broad market and/or a break of the JPM rising wedge pattern before taking a short position. Targets & stops TBD upon entry. (edit: targets listed on chart were from previous trade and have not been updated).