As mentioned last week, numerous trade ideas have recently hit one or more profit targets. For categorical purposes, static charts are posted as profit targets are hit on the trade ideas on RSOTC. This provides a pictorial history of the trade ideas from trade setup, breakout/entry, and how the stock reacts at each profit target, which can be used as an education resource in which to study the past price action of a particular stock or technical price pattern. All posts on RSOTC, including failed trades, market analysis, etc…, are archived indefinitely and can be easily referenced by using the symbol tagging system.

As I took some time away from trading over the last week (a must from time-t0-time in order to prevent trader burn-out), I am going to focus my efforts on updating those trades that recently hit an intermediate or final profit target. As most of those trades were already mentioned on Friday, email notifications will not be sent out on each static chart update. Just a quick note that my degree of confidence on the near-term direction of the market is still not very clear and as such, I plan to keep things light for now (both my trading/positioning as well as market updates).

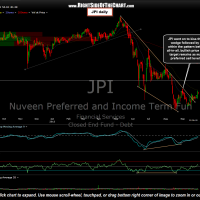

- JPI Long Entry Aug 28th

- JPI update Oct 1st

- JPI Final Target Hit

With that being said, here is the updated daily chart of the JPI Growth & Income Trade along with the previously posted charts. JPI hit the final (and only) price target of 23.18 to the exact penny last week before reversing, providing this trade with a total return of 9.6% (including $1.33/share in distributions paid out since entry). As with most of the other Growth & Income Trade Ideas that have recently hit there final price target, these trades may very well continue to provide attractive returns for investors seeking above average yields. As a more active trader, my preference was to close these positions when my final target was hit in order to redeploy that capital into other trades with a better R/R profile and higher profit potential. In other words, now that my final target has been hit on JPI and several other of the recent G&I Trades, I believe that the bulk of the “Growth” component has been milked from these trades, at least in the near-to-intermediate term. However, the high dividend yields, i.e.-“Income”, on these trades may still provide an above average return for investors, particularly those who entered these trades at lower levels. If so, stops can be raised at this point in order to protect profits while continuing to collect the above average dividend payments. As 23.18 was my final target for JPI, this trade will now be moved to the Completed Trades category where it will be archived for future reference.