The JO (coffee ETN) Active Trade Idea was updated earlier today after hitting the third price target for an 18.3% gain on Wednesday & I also covered the long-term (20+ year weekly) chart & outlook for coffee in the video published a few minutes ago. However, I wanted to follow up with the very near-term outlook of coffee along with my thoughts on the trade. Previous & updated 60-minute charts below.

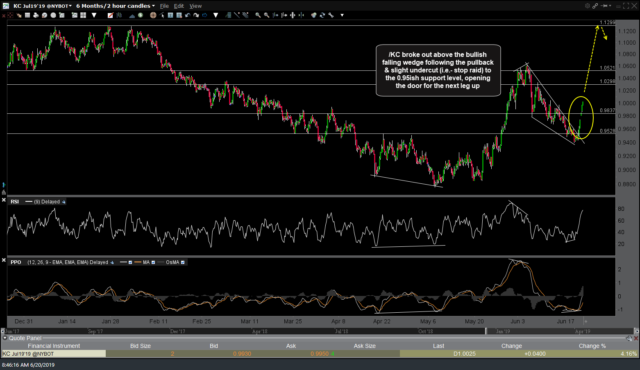

- KC 60-min June 17th

- KC 60-min June 20th

- KC 60-min June 24th

- KC 60-min July 5th

Multiple charts in gallery format, such as these, may not appear on email alerts. Click first chart in gallery to expand, then click on right of chart to advance.

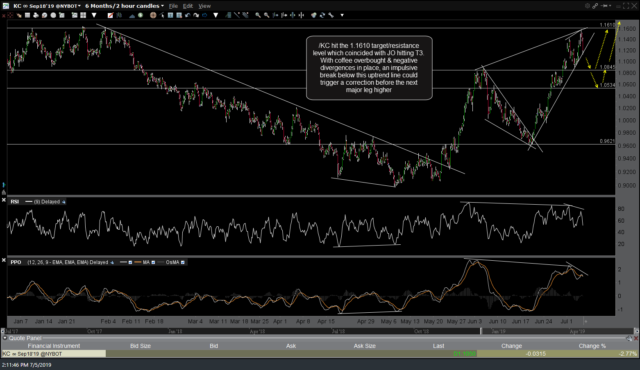

Along with JO hitting T3, /KC (coffee futures) also hit my 1.16 target/resistance level as well. With coffee overbought & negative divergences in place, an impulsive break below this uptrend line could trigger a correction before the next major leg higher. Essentially, while the odds for a pullback in the near-term are elevated at this time, I remain longer-term bullish on coffee, especially if it can make an impulsive breakout above the recent highs as not only would that take out this 1.16ish resistance but it would also trigger a breakout above the more significant long-term downtrend line which I covered in today’s video, thereby providing a powerful, longer-term buy signal for coffee. Previous & updated 20+ year weekly charts of $COFFEE below.

- $COFFEE 20 yr weekly May 24th

- $COFFEE 20-yr weekly June 6th

- $COFFEE 20-yr weekly July 5th