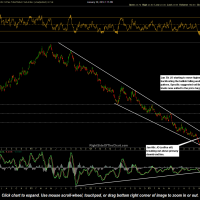

The JO (Coffee ETF) has started moving higher after backtesting the bullish falling wedge pattern since the breakout earlier this month. JO remains one of my favorite trades in the commodity sector at this time and remains both a typical swing trade (Active Long) as well as a Long-term Trade Idea, as JO may be in the very early stages of a new primary uptrend/bull market. Despite the strong advance over the last couple of days, JO is only trading slightly above the original entry (breakout level) and still offers an objective entry with stops inline with one’s preferred target. There is also a significant support level around 22.00 in which a stop could be placed slightly below (not much below 21.65).

Ideally, stops should place depending on one’s average cost (i.e. entry price or prices, if scaling in) using a R/R (risk-to-reward ratio) of 3:1 or better. e.g. $1 of downside risk for every $3 of targeted gain potential. Therefore, long-term traders or investors targeting T3 at 33.98 (a gain of $10.40 from current levels) or higher could place a stop somewhat below the November lows of 20.37 (a loss of 3.21 if stopped out), giving the trade an R/R of 1:3.2 or better, if shooting for a target above T3. Those targeting T1 or T2 might consider a more aggressive stop.