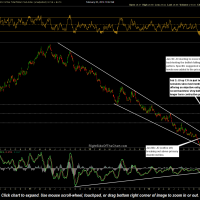

The JO (Coffee ETF) long trade is up 13% in just two trading sessions since last mentioned as one of the more promising trades still offering an objective entry. As prices are now approaching the first profit target (T1 at 27.72), consider raising stops to protect profits and have your sell limit order in place if your trading plan includes booking partial or full profits at T1.

As usually, the primary reason that I am bullish on precious metals and commodities is first & foremost the technicals (charts). However, a secondary factor that I think might come into play is a large rotation of money from lofty equity prices into the beat-down commodities sector as regardless of any tapering by the fed, there is still a tremendous amount of liquidity sloshing around global financial markets that must find a home somewhere. Therefore, if profit taking in equities continues, we could see a good deal of that money finding its way into select commodities & the precious metals sector. Just a theory but if it holds water, the charts will likely confirm.