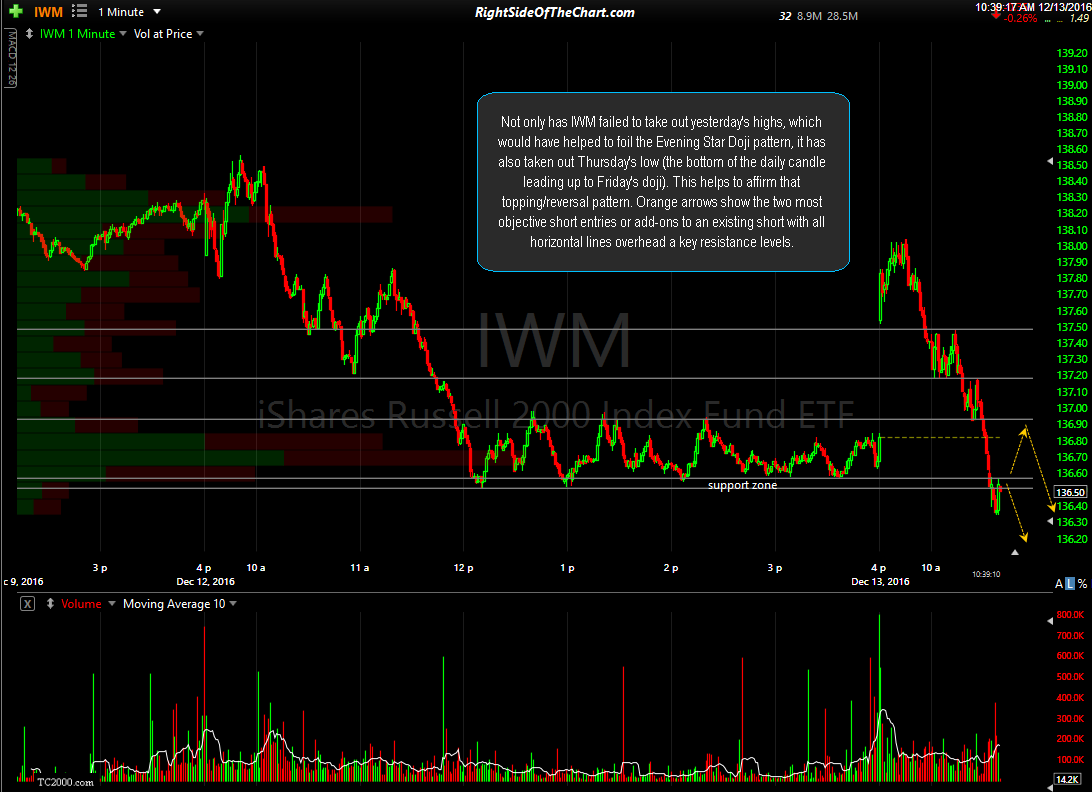

Not only has IWM failed to take out yesterday’s highs, which would have helped to foil the Evening Star Doji pattern, it has also taken out Thursday’s low (the bottom of the daily candle leading up to Friday’s doji). This helps to affirm that topping/reversal pattern. Orange arrows show the two most objective short entries or add-ons to an existing short with all horizontal lines overhead a key resistance levels. 1-minute chart:

Note: IWM is not an official short trade idea. While the case for a pullback can & has certainly been made recently, the fact that we have the FOMC rate announcement on deck for tomorrow afternoon coupled with the fact that there isn’t enough supporting evidence with the SPY & QQQ at this time to strongly support the case for anything much more than a relatively quick, overbought pullback trade on the small caps, I’m primarily posting frequent updates on IWM as there is a lot of interest & positioning from members in the trading room. Potential pullback targets remain as posted on the recent IWM 60-minute charts.