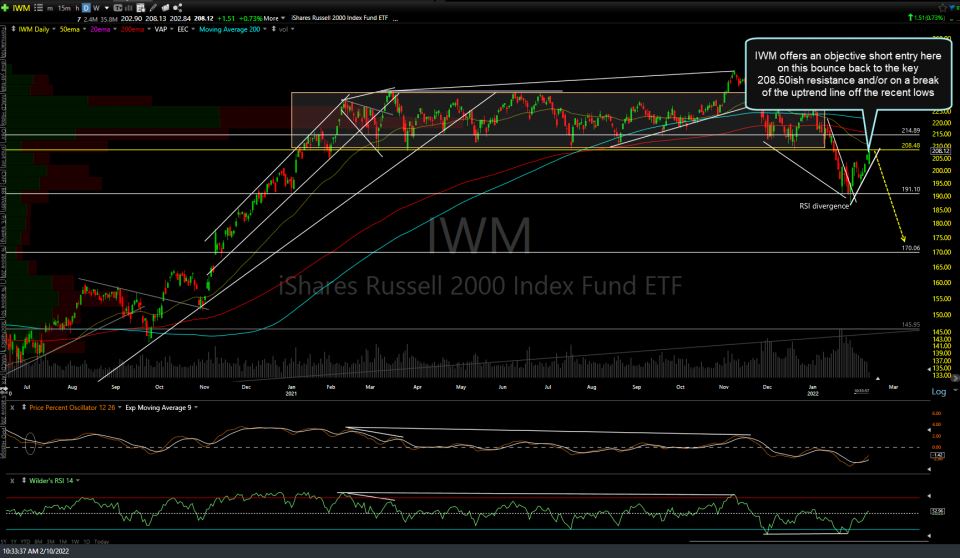

IWM offers an objective short entry here on this bounce back to the key 208.50ish resistance and/or on a break of the uptrend line off the recent lows with stops in line with one’s preferred price target(s). 170 still remains the next swing/trend target to the downside & the (expected) reaction off the initial tag of the 191 support (which coincided with QQQ hitting T1 on the daily & weekly charts) appears to have likely run most of all of its course at this time. However, with volatility still high, using stops based on daily closes vs. intraday moves above resistance or a particular price level will minimize getting clipped out of a swing or trend position on a stop-raid or just the large intraday swings that have become the norm recently. Daily chart below.

Likewise, /RTY (Russell 2000 Small-cap Index futures) also offers an objective short entry here on the bounce back to the comparable key 2100 resistance level. While there are never any guarantees in trading, I have to say this appears to be one of the most objective short entries or add-ons I’ve seen on the Russell 2000 since the attempted breakout above the year-long trading range (and new all-time highs) failed back in November as well as the break below the bottom of the range last month. 120-minute chart below.

Additional ETF proxies for trading the small-caps are RWM (-1x short), TWM (-2x short), & TZA (-3x) with /M2K (Russell 2000 Micro Eminis) an alternative to /RTY that trades at the same price (hence, same chart as above) but uses a smaller multiplier (leverage factor).