IWM appears to have completed an Evening Star Doji bearish reversal pattern over the last 3 trading sessions. Should prices continue to move lower in the coming sessions, that would confirm the high-level potential negative divergences on the PPO, MACD, RSI & other indicators on the daily time frame as well as help to firm up my scenario of a wedge over-throw, increasing the odds for a move back down to at least the 125 area in the coming days/weeks.

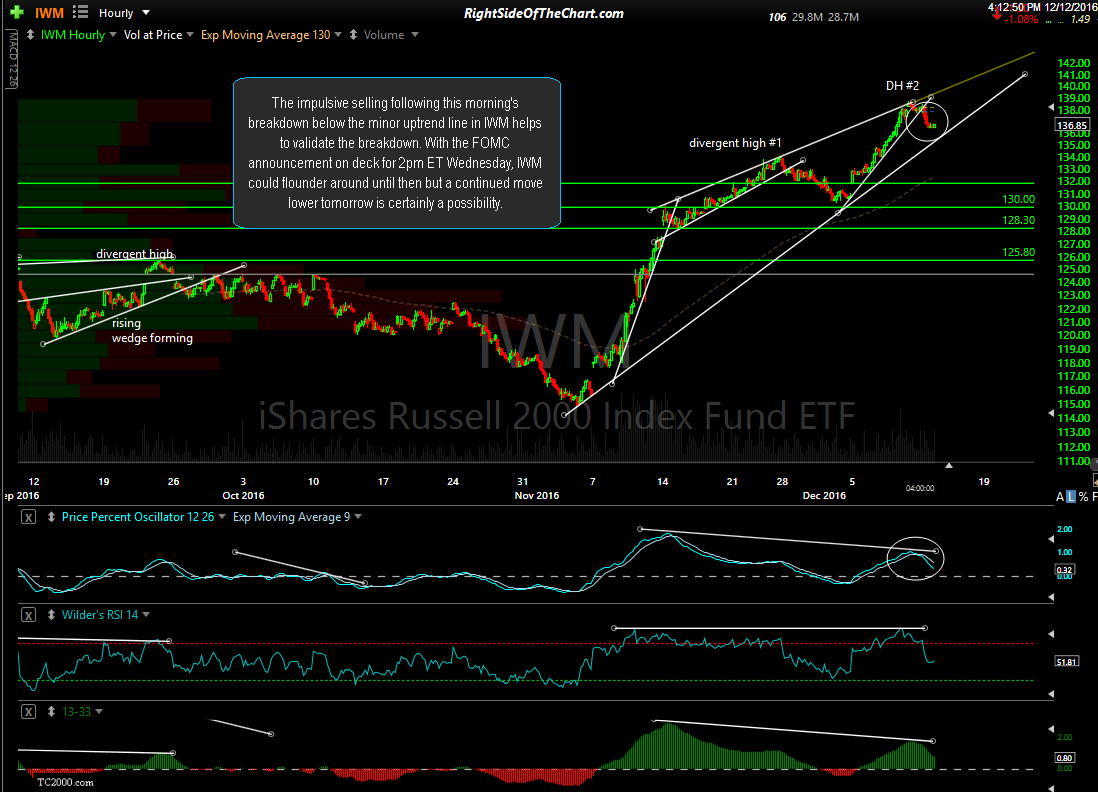

Zooming down to the 60-minute time frame, the impulsive selling following this morning’s breakdown below the minor uptrend line in IWM helps to validate the breakdown. With the FOMC announcement on deck for 2pm ET Wednesday, IWM could flounder around until then but a continued move lower tomorrow is certainly a possibility.