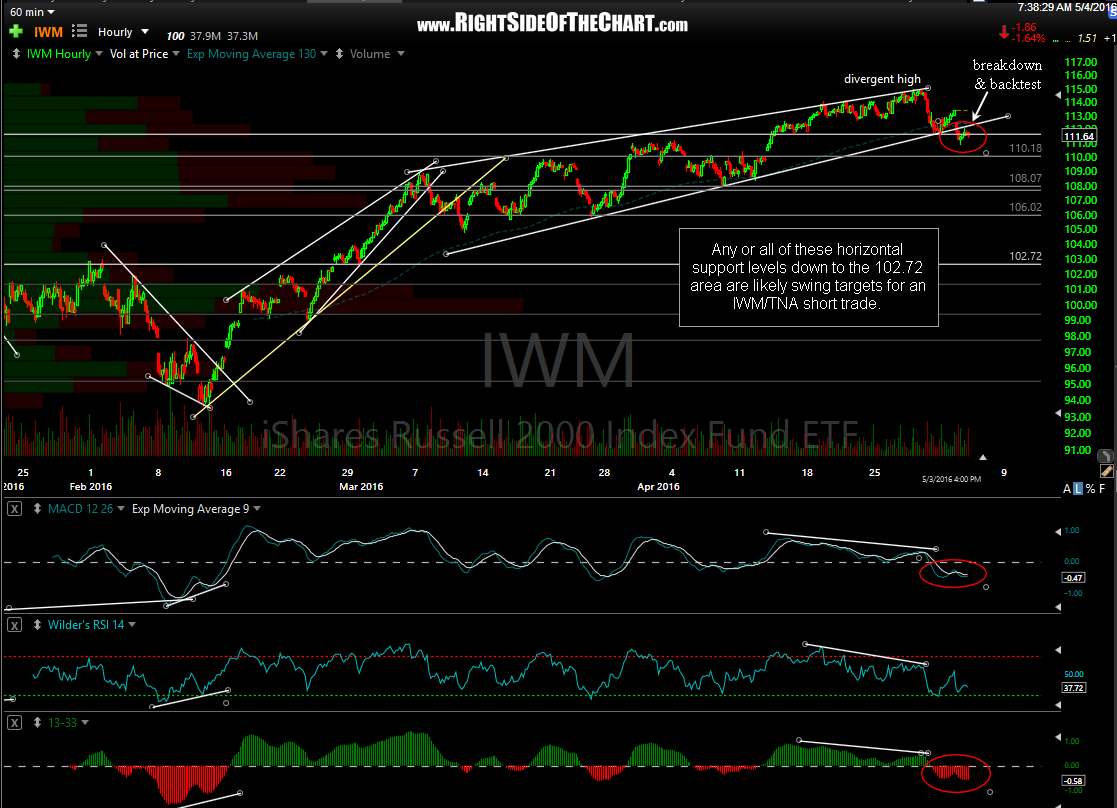

I’ve had several inquires lately about IWM (small cap ETF) as a short candidate to which my reply was; Yes, as a risk-on/risk-off higher-beta index, similar to QQQ, IWM will most likely outperform the large cap index tracking etfs such as SPY & DIA, should the markets move lower in the coming days, weeks or possible months. In fact, with IWM only recently breaking down below this wedge pattern & backtesting yesterday, it looks like there is plenty of meat on the bone left for a swing short trade on the small-caps (my preference being a TNA short). Any or all of these horizontal support levels down to the 102.72 area are likely swing targets for an IWM/TNA short trade.

IWM Downside Targets/Support Levels

Share this! (member restricted content requires registration)

4 Comments