With the recent volatility over the last few weeks, both of the most recent QQQ & IWM/TWM short trades exceeded their suggested stops. As stated here back on April 13th, that last TWM trade exceeded the suggest stop by mere pennies and for consistency, that trade was officially considered stopped out for a small loss and moved to the Complete Trades category. I still haven’t had the time to update the QQQ and several of the other trades that exceeded their suggested stops over in the last couple of months although I hope to do soon.

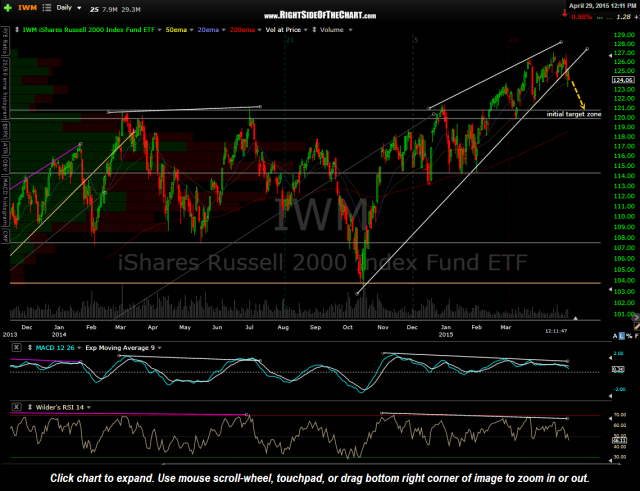

With that being said, although the IWM and QQQ trades aren’t ‘official’ shorts at this time, I will continue to update the US index charts and where I think they are headed. Here’s the daily chart of IWM showing the recent breakdown below the bearish rising wedge pattern (complete with negative divergence below) and my initial price target zone, which runs from about 120.80 down to 119.90. I’ve warned that the selling was likely to accelerate for so many weeks now that I probably sound like the Boy Who Cried Wolf but with that being said, it still looks to me that a sharp move lower in US equities is close at hand.

I’ve posted several individual short setups recently and plan to add some more this week. I still like (and am personally short) all the airline stocks posted yesterday. I also just received a price alert on a breakdown in ESRX (large rising wedge pattern on daily chart, final price target around 79.00). I will posts charts & detailed notes as time permits but will also continue to rely on the twitter feed to quickly post any time sensitive trade ideas & market developments.