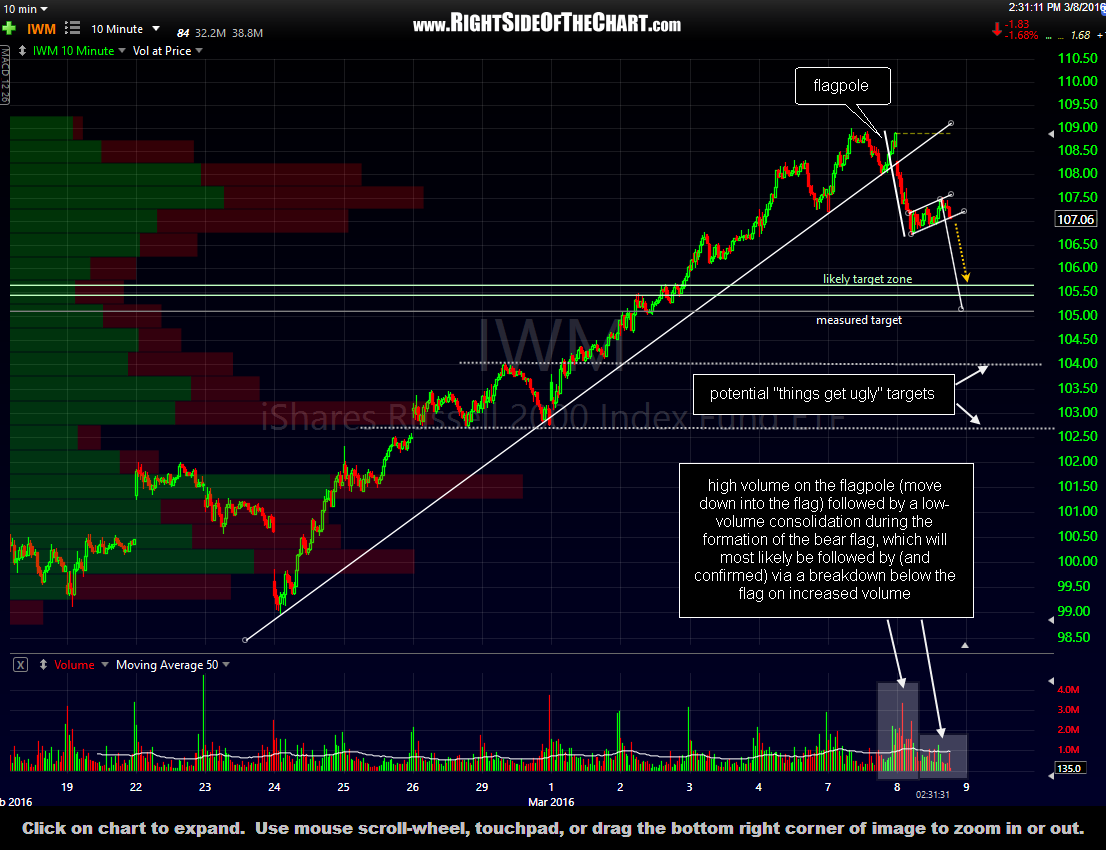

The bear flag formation highlighted early today on IWM (Russell 2000 Small Cap ETF) in the trading room looks ripe for a breakdown. So far, this continuation pattern has formed as expected, with an impulsive move down on above average volume to form the “flagpole” followed by a low-volume consolidation as prices moved slightly higher in a well-defined “flag” pattern. All we need now is the catalyst for the next leg down which would be a downside break of the pattern, preferably on above average volume.

Although the small caps are my preferred broad market index to short at this time for the reasoning highlighted in today’s video, I’ll always keep a close eye on the major large caps indices (SPY, QQQ, etc..) to confirm or refute a breakdown in the small caps. With just over an hour left in the trading session, even if IWM breaks down from this pattern soon, there’s a good chance that the bulk of the downside follow-thru will take place tomorrow, quite likely on an opening gap down.

IWM is not an official trade idea at this time although active traders might opt to position short the small caps on a break below this pattern. TWM is the 2x short small cap, TZA is the 3x short & my preference yesterday was to short TNA, the 3x long small cap ETF, as I’m very open to the possibility that this trade could morph into a multi-week or even multi-month swing trade. If so, the decay from the 3x leverage should work in my favor.