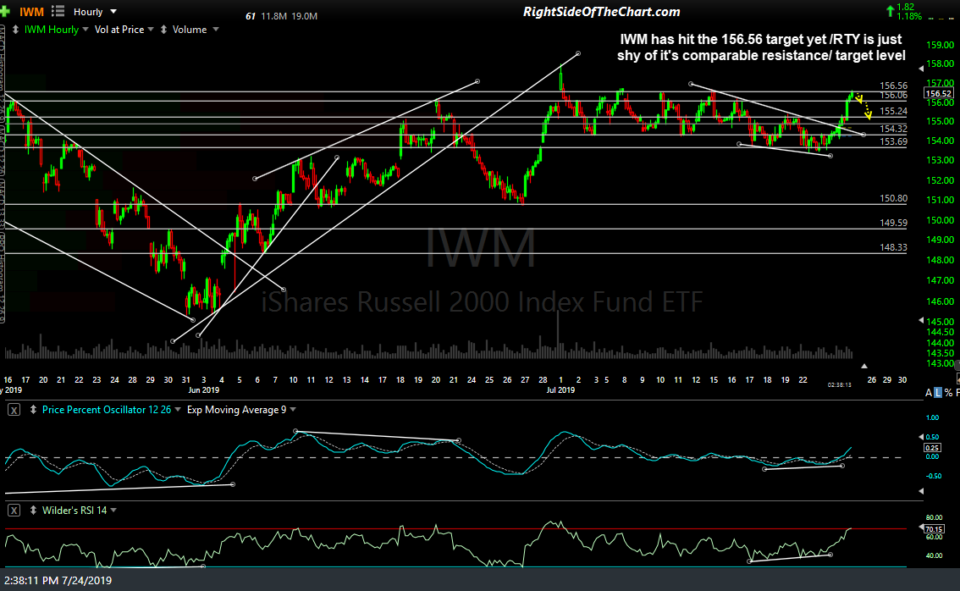

/RTY (small-cap futures) is still shy of the 1582ish resistance level/price target for today’s bullish falling wedge pattern breakout although I’ve added another resistance level at 1578.80 which could come into play with IWM current trading just above my 156.56 final near-term target for today’s falling wedge breakout rally. /RTY only had a very minor reaction at the 1573 resistance level today which did not provide the same pullback trading opp. as the initial tag of the 1565 R level did earlier today, which provided a 0.3% pullback before the resumption of the rally.

With IWM at resistance & /RTY slightly below, this is a good time as any to either raise stops or book profits for a quick 1¼% day trade without the risk of giving back any of those gains on a potential gap down tomorrow or reversal in the final hour of trading today. IWM could very easily continue to rally & power through this resistance level, which is the top of the sideways consolidation range since the beginning of this month so again, once could opt to raise or trail stops at this point to protect profits in lieu of booking profits although opening gaps against a position can bypass a well-place stop order, hence the decision to let a winning trade run or lock in profits to avoid risking giving some or all of them back.