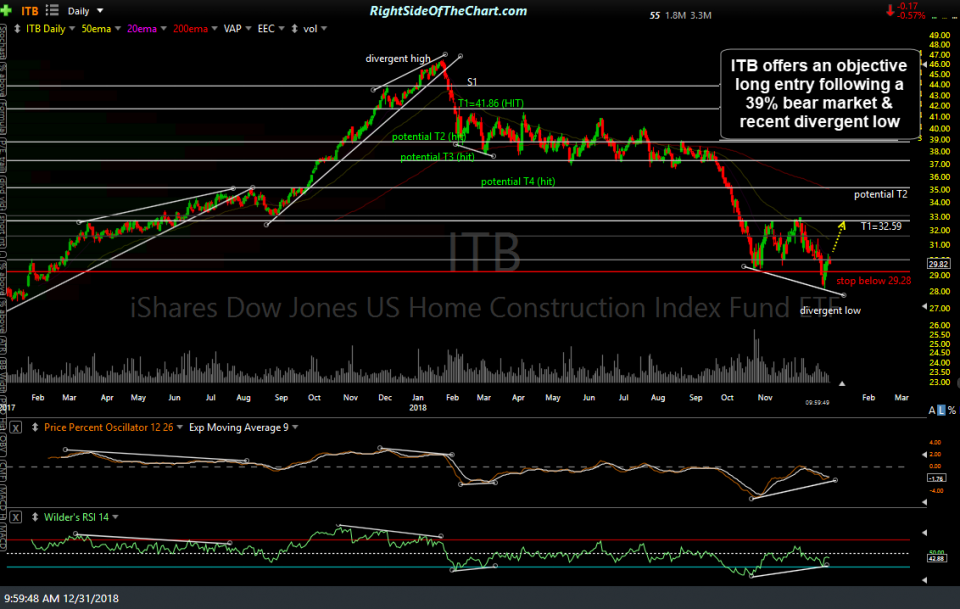

ITB (U.S. Home Construction Index ETF) offers an objective long entry following the 39% bear market off the early 2018 highs along with the recent divergent low while oversold at long-term support. 2-year daily chart below:

The sole price target at this time is T1 at 32.59 with the potential for an additional price target to be added around the 35.20 level, depending on how the charts develop going forward. The suggested stop is any move below 29.28 with a suggested beta-adjusted position size of 1.0. 10-year weekly chart below:

One additional consideration to be made in determining one’s position size, should you decide to take this trade, is that I am considering adding some individual stocks with the home construction sector (homebuilders, home improvement stores, lumber companies, etc.) & will post a video later today highlighting some of the individual stocks that stand out as potential swing trading candidates. As such, one might opt to earmark a certain portion of their available funds that they plan to allocate to the home construction sector. Also, note that XHB (SPDR S&P Homebuilders ETF) is another alternative to trading the homebuilding sector.