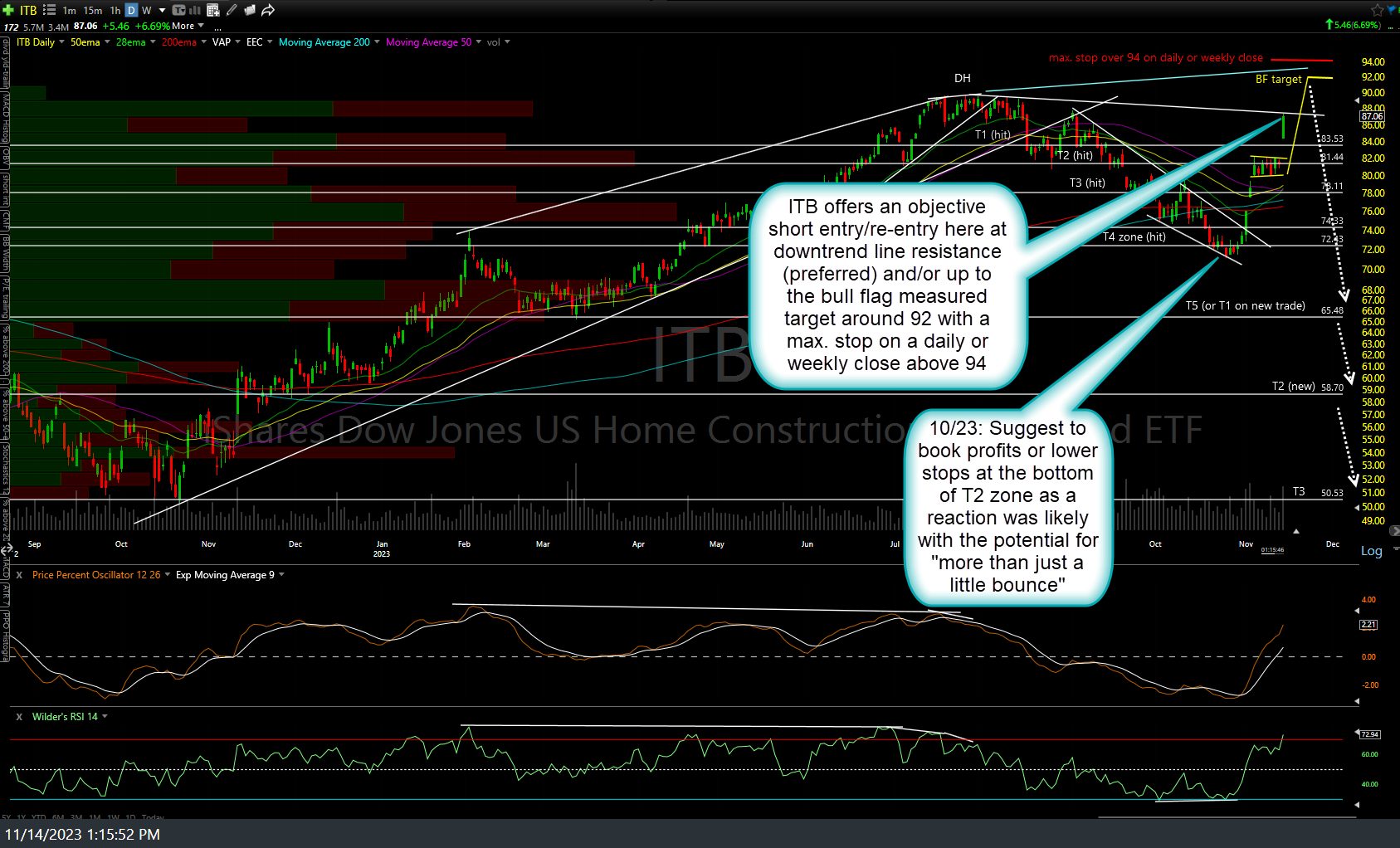

ITB (home construction ETF) offers an objective short entry/re-entry here at downtrend line resistance (preferred) and/or up to the bull flag measured target around 92 with a max. stop on a daily or weekly close above 94.

ITB and many of the individual stocks within the home construction/home builders sector were highlighted a some of my favor swing short trade ideas going back to around the initial sell signal on the bearish rising wedge breakdown in early August, with subsequent sell signals/objective add-ons highlighted since. The last update on ITB was here in the Oct 23rd trade ideas video where I suggested booking profits at the bottom of the T4 target zone stating:

“The odds favor a reaction here”… (and)… “Quite a few of those things I’ve been bearish on & short on are setting up with positive divergence that could indicate we are looking at more than just a little bounce if these divergences play out and these support levels hold.”

…which they very much did.

It appears that bounce has now either fully or mostly run its course with the next leg down to begin soon. The chart above shows ITB current testing the downtrend line off the July/Aug highs as well as a potential bull flag pattern & measured target (in yellow), which has the potential to put in a marginal new high in ITB, before the turn comes. If so, there is a good chance that any marginal new high (f it happens soon) would be a divergent high due to the current posture of the momentum indicators.

As such, one could opt to take a full short position here (my preference), providing an attractive R/R of 4:1 to my new current final swing target (new T3 around 50.50), although I will most likely be adding additional downside targets if/as ITB begins to approach that level due to the developments that will have occurred on the longer-term charts at that time, especially if the new T1 (T5 from previous trade) around 65.50 is taken out.

Another more conservation option (as there are zero sell signals on ITB, which is in a strong near-term uptrend right now) would be to take a starter position here, scaling into that short position up to but not above the measured target of the bull flag pattern around 92 with stops commensurate with your average cost basis on the position and/or depending on the technical posture of ITB at the time.