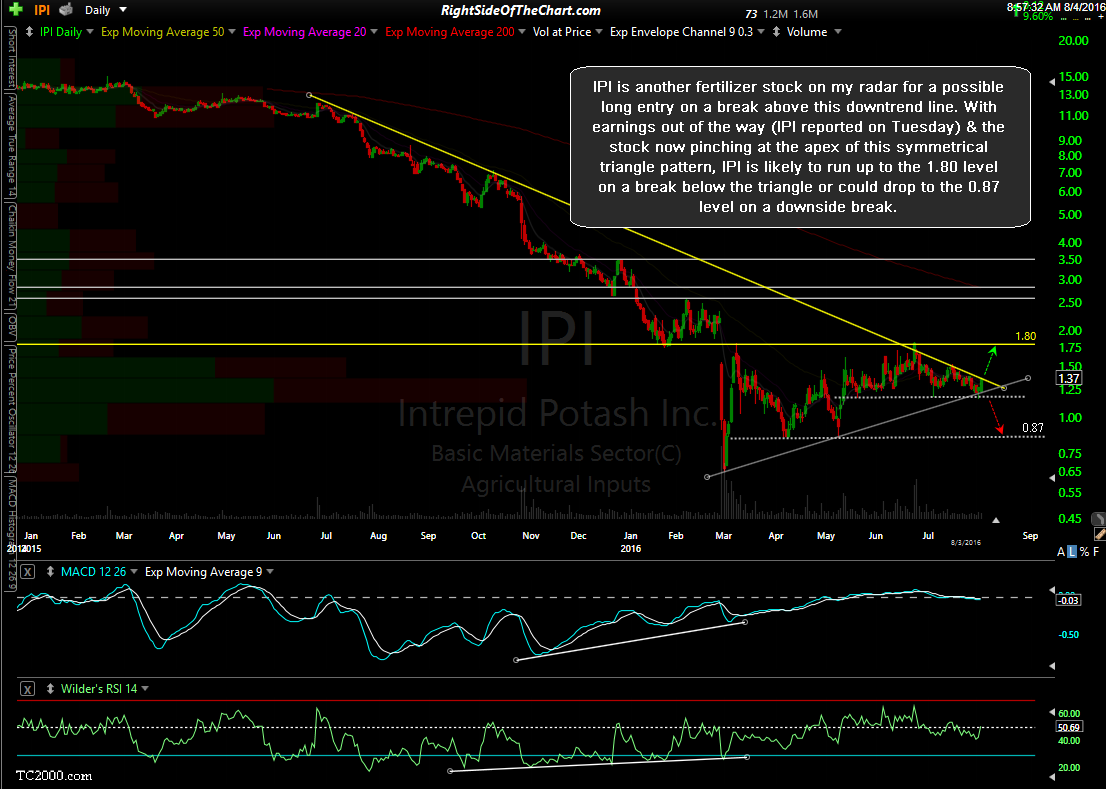

IPI (Intrepid Potash Inc) is another fertilizer stock on my radar for a possible long entry on a break above this downtrend line. With earnings out of the way (IPI reported on Tuesday) & the stock now pinching at the apex of this symmetrical triangle pattern, IPI is likely to run up to the 1.80 level on a break below the triangle (favored) or could drop to the 0.87 level on a downside break. As IPI is a low-priced ($1.37/share) stock with only a $95M market cap, this is very aggressive & unofficial trade setup for those interested.

Unofficial means that this trade idea may or may not have any follow-up posts, the price targets shown here are the actual support & resistance levels, unadjusted for an optimal fill & suggested stops are not provided (although I will be glad to share my thoughts if anyone takes it & posts an inquiry in the trading room). Also note that the downtrend line on the triangle pattern has been slightly revised (lower) from the previous post on IPI a few weeks ago.

Also note that as with any long-side breakout, ideally you want to see the breakout occur on above average volume (1.5x or better) in order to confirm. Breakouts that occur on average or below average volume have a considerable higher failure rate. I would also point out that the risks of being short a low-priced ($1.00ish) stock, should IPI break below the triangle pattern are very high & personally, I’d only consider a long-side trade on this stock.