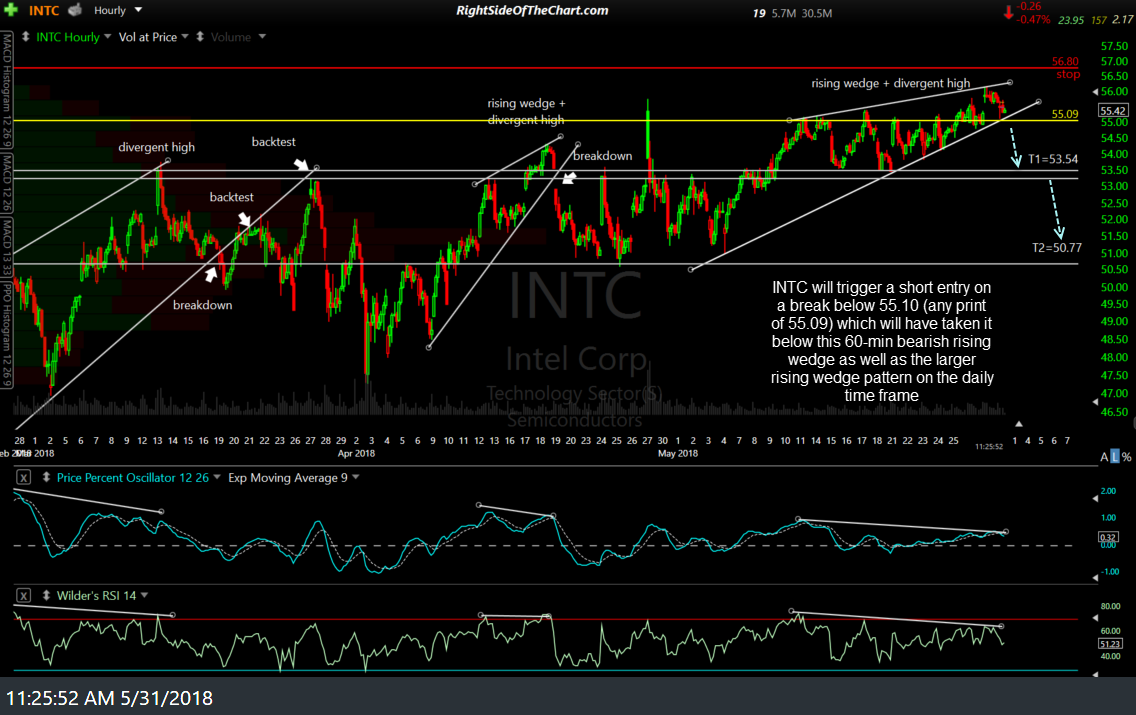

INTC will trigger a short entry on a break below 55.10 (any print of 55.09) which will have taken it below this 60-min bearish rising wedge as well as the larger rising wedge pattern on the daily time frame.

- INTC 60-min May 31st

- INTC daily May 31st

The price targets are T1 at 53.54 & T2 at 50.77 with the possibility of an additional price target to be added around the 43.00 area, depending on how the charts of INTC, as well as the semiconductor sector, develop going forward. The suggested stop is any print of 56.80 with a beta-adjusted position size of 1.0.

Should Intel find support on this pullback to the uptrend line & rally from here, I may look to revised the entry criterion on this trade to short at a higher level within the wedge pattern ..and yes, IF this trade pans out, that would most likely mean that the semiconductor sector is also headed lower & as such, one could also use as short on SOXX, XSD or SMH as well as a long on SOXS (3x short semicondutor sector ETF) as a proxy for a short on INTC.