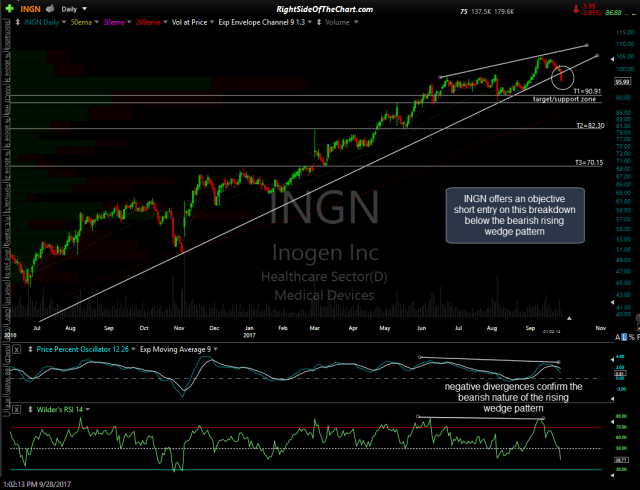

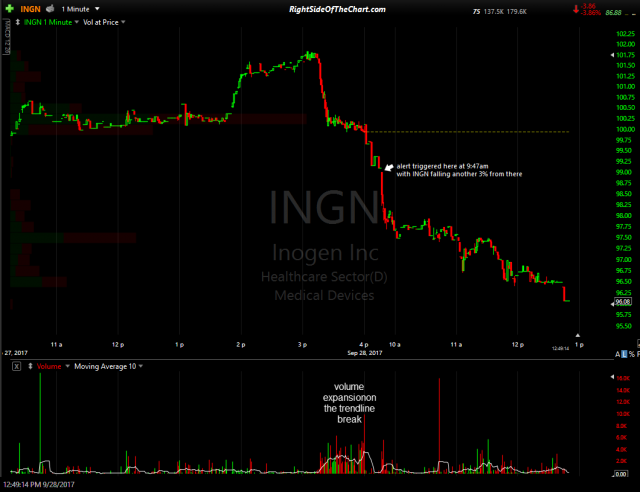

Those that viewed the XLP Consumer Staples video earlier today would have noticed a price alert that popped up on my screen while recording that video. The alert was triggered on a breakdown below the primary uptrend line/bearish rising wedge pattern on INGN (Inogen Inc), which was covered as a short trade setup in the IHI & Medical Device Sector Trade Ideas video posted on Tuesday.

- INGN daily Sept 28th

- INGN 1-minute Sept 28th

This was a beautiful setup & today’s breakdown provided a very objective entry as the breakdown was confirmed with volume expansion. The stock also provided an objective entry as it didn’t gap below the trendline or fall very sharply, rather prices continues to gradually fall since the breakdown but as I was recording the video at the time & busy afterwards, I did get around to checking that alert & the chart until now. Hopefully some were able to catch this one shortly after that breakdown.

While I would have preferred an entry shortly after the breakdown, the stock still offers an objective entry here around the 96 level, as the 3 price target range about 5.25%-27% below current levels. Should the stock backtest the wedge from below or even just experience a minor kickback rally soon, that might present another objective short entry or add-on to a position taken here.

INGN will be added as an Active Short Trade here around the 96 level. The price targets are T1 at 90.91, T2 at 82.30 & T3 at 70.15. The suggested stop will be any move above 104.30 with a suggested beta-adjusted position size of 0.90.