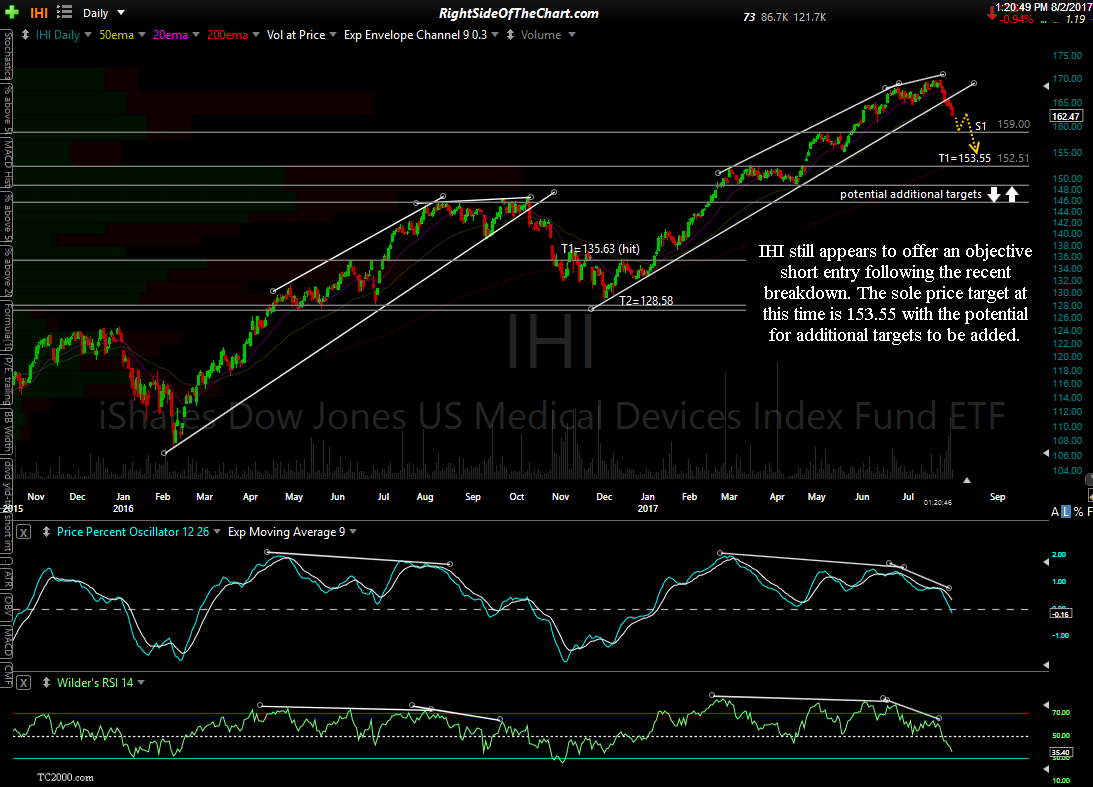

IHI (Medical Devices Index ETF) still appears to offer an objective short entry following the recent breakdown & will be added as an official trade idea around current levels. IHI & many of the leading medical device stocks were recently highlighted as attractive short trade ideas in the IHI & Medical Device Trade Ideas video posted earlier this week.

The sole price target at this time is 153.55 with the potential for additional targets to be added depending on how the charts of IHI & the broad market develop going forward. The suggested stop for this trade is any move back above 165.80 with a suggested beta-adjustment of 1.0. I will also be adding some of the medical devices stocks that were covered in Monday’s video as official trade ideas as well so keep that in mind when/if planning to allocate a certain percentage of your portfolio to this sector.

IHI is now oversold on the 60-minute chart at minor support which increases the odds for a reaction although I expect any counter-trend rally at this point to be relatively small & fleeting. The first significant support where I would put very good odds on a reaction is the 159 level, particularly if the intraday charts confirm the likelihood of a bounce. The 159 level could also serve as a price target for those preferring to book quick but relatively minor profits (about 2% below current levels) or a possible reversal (from short to long to game the bounce, then back short again for the ride down to T1) for active traders.