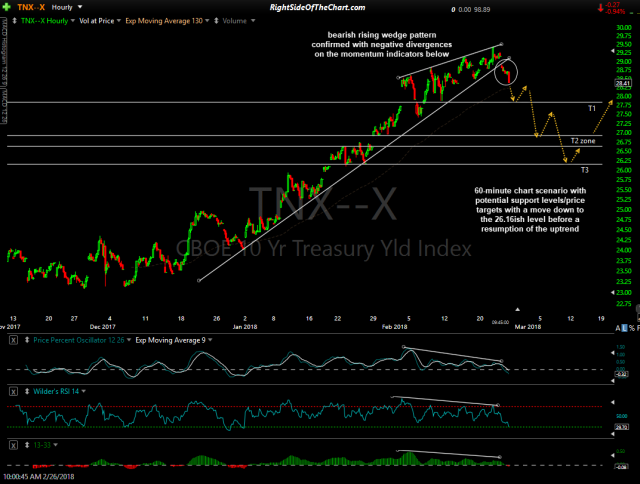

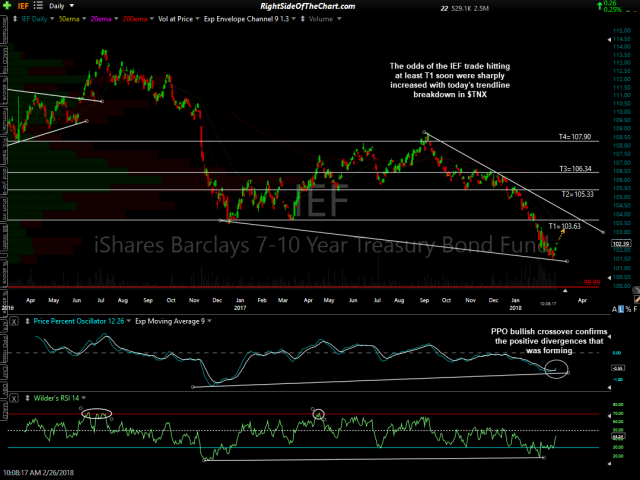

$TNX (10-year US Treasury Yield Index) has made an impulsive breakdown below the recently highlighted uptrend line, thereby triggering a sell signal on 10-year treasury yields which correlates to a buy signal on the IEF (7-10 year Treasury Bond Fund ETF) Active Long Swing Trade. Treasury bond prices (IEF) are inversely correlated with yields ($TNX) meaning one goes up when the other goes down & vice versa. Member @jrandhawa in the trading room requested my near-term & longer-term outlook for $TNX which is essential a move down to the 26.16ish level before a resumption of the update with potential support levels where reactions are likely shown on the 60-minute chart below.

- $TNX daily Feb 26th

- $TNX 60-min Feb 26th

- IEF daily Feb 26th

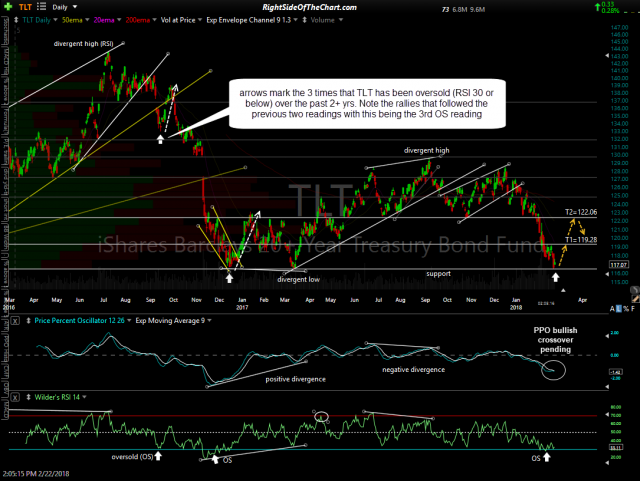

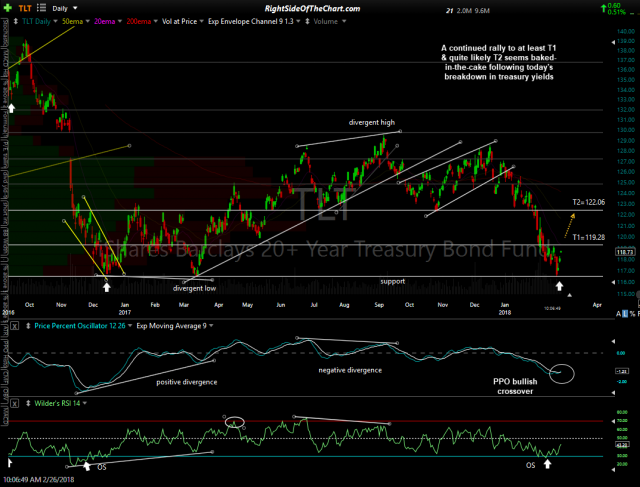

$TYX (30-year US Treasury Yield Index) also made a comparable trendline break today which increases the chance that the price targets which I posted last Thursday (first chart below) will be hit in the coming days & weeks+.

- TLT daily Feb 22nd

- TLT daily Feb 26th