the $SPX gapped below that critical 1420 support that i mentioned on sunday evening, thereby triggering the final high-probability sell signal and triggering the second entry on the IBB short trade (as discussed here). although a stick save by the fed to close the $SPX back above 1420 is possible, i do not believe that it is likely, at least not anything that will stick for more than a few days at best.

the $SPX gapped below that critical 1420 support that i mentioned on sunday evening, thereby triggering the final high-probability sell signal and triggering the second entry on the IBB short trade (as discussed here). although a stick save by the fed to close the $SPX back above 1420 is possible, i do not believe that it is likely, at least not anything that will stick for more than a few days at best.

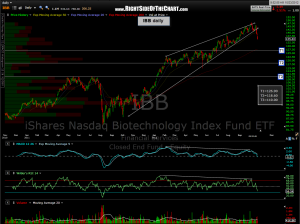

i continue to believe that we are still in the early stages of that reversion to the mean that i’ve been discussing lately, whereby stock prices must now play a painful (or very lucrative, depending on which side of the trade you are on) game of catch-up to the fundamentals which have clearly been deteriorating for most of the year. until i see convincing evidence from both a fundamental and technical perspective to the contrary, i will continue to use any fed-induced rallies as opportunities to tactically add short exposure (e.g.-shorting bounces back to resistance levels) while preferring the larger, swing targets on most trades. updated IBB daily chart shown here (still one of my favorite sectors to short at this point):