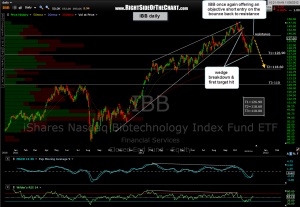

The IBB short trade is once again offering an objective entry here on the bounce back to resistance following the recent tag of the first price target. Those targeting T2 or T3 might consider a stop over the 141.50 area (a 4:1 or 6.75:1 R/R) while those targeting one more drop to T1 should consider a tighter stop, somewhat above the 138.80 resistance level shown on this updated daily chart.

The IBB short trade is once again offering an objective entry here on the bounce back to resistance following the recent tag of the first price target. Those targeting T2 or T3 might consider a stop over the 141.50 area (a 4:1 or 6.75:1 R/R) while those targeting one more drop to T1 should consider a tighter stop, somewhat above the 138.80 resistance level shown on this updated daily chart.

One could use the 2x leveraged long and short etf’s, BIB & BIS, as proxies for this trade. Just make sure to adjust your position size accordingly to account for both the leverage on these two etf’s as well as the inherent volatility in the biotech sector.