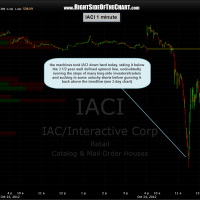

ah, the games people machines play. as you can see from this 1 minute chart (or the candlestick with the massive tail as viewed on any daily or this 2-day chart), there were a lot of traders, both longs & shorts, burned on the fake-down move in IACI today. the 2-day chart shows how prices broke below that 3 1/2 year uptrend line, undoubtedly taking out a large quantity of stops that would have logically been placed just below that level (and most likely sucking in a lot of shorts in the process). in this day and age where the machines (HFT) rule, this looks more like an orchestrated, and very profitable ploy by those will a large enough bank roll and fast enough processor to pull-off such an act:

go short in advance; then overwhelm the bids with all those flash orders and other gimmicks they use, thereby bringing prices below the TL where all the long-side stop loss orders are parked; as prices plunge from an imbalance of sell orders, start covering the shorts & then some to go net long; then flip the switch and start gunning it to the upside, bring the stock back above the uptrend line, aided of course by short-covering from those who realize that they’ve been duped.

regardless of today’s fake-down, which is typically viewed as a bullish event (i.e.- a bear-trap), i do believe that the next breakdown below this daily/2-day uptrend line will stick and i believe that it will happen soon (all these stock manipulation games do is to cause both buyers to lose interest in the stock and start to unload). weekly chart shows a nice, over-extended channel that has broken down for the second time this year, this time on a more impulsive move, with divergences in place to boot. IACI will trigger a short entry on the next break below the daily or 2-day period uptrend line. targets markets on daily chart, stops TBD upon entry.