I have no desire to immerse myself in the financials of HLF, or any other trade for that matter (a trade is not to be confused with an investment, which is a planned long-term hold of a position whereby fundamentals are very important). However I do often glance the quick fundamental stats and other metrics on trade candidates before I take them (such as short interest, p/e ratio, debt-to-income ratio, etc..). However, one of my reasons side with Bill Ackman on the HLF trade, besides the fact that after listening to their recent exchange of words and Icahn rambling on about his stake in HLF on CNBC today, is this: Even assuming that Icahn is correct about the true worth or valuation of HLF based on their past & projected financials such as cash flow, debt-to-income ratio, etc.., I believe there is a very high probability that the future earnings prospects of the company will be diminished simply based on the pyramid scheme accusations (right or wrong) that Ackman has made.

In my 43 years, I’ve seen plenty of MLM (multi-level marketing) fads come & go, most, if not all being pyramid schemes, at least effectively if not in the literal sense because the many people that I’ve known to succumb to the allure of “easy money” ended up wasting not only their time but their own (seed or buy-in) money as well. I understand there are exceptions and with the amount of visitors to this site each day, I’m bound to have offended someone who has had an experience with a MLM company, good or bad, and if so, my apologies. I’m just generalizing what my indirect experiences have been with these companies (Indirect in the sense that I have never entertained the though of joining one although I have been solicited many times over the years and know several people who have lost time and/or money to these MLM companies).

In the electronic age that we live in, what used to take hours, if not days, of due diligence is typically done in minutes or even seconds with a quick Google search. Assuming I were to sit through the 10 minute sales pitch from a Herbalife rep and my interest in joining their “team” was piqued, my next step would be to do a web search on the company to see what others have to say about it. Here are the auto-fills that I get when I type in “Herbalife is…” into Google, not exactly the type of thing that a prospective sales rep/distributor wants to see.

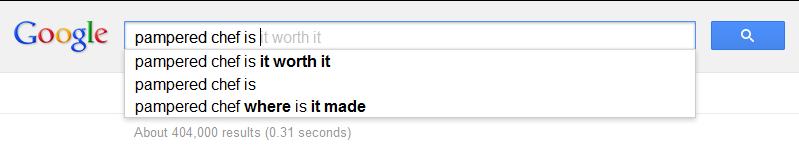

Just to “check” my bias, I tried the same thing on a MLM company who I believe offers a great product (although I don’t have any knowledge of their financials or their business model, other than the fact they employ a MLM distribution strategy). My wife has purchased quite a few items from Pampered Chef reps and I find them to be of high quality, very useful and quite novel. Just to see if Google would produce the same negative results, here’s what I get when typing in “pampered chef is…”:

Not quite the negative responses picked up by Google when crawling the web for the most commonly used phrases with Herbalife, which helps confirm my theory that even if Carl Icahn is right and Bill Ackman is wrong on the current fundamentals of HLF, that all the negative light that Ackman is shedding on HLF by stating unequivocally that HLF is a pyramid scheme is likely to ultimately discourage a significant number of potential of new salespeople (i.e.-investors as HLF makes money by selling the product to the sales reps for mark-up & distribution to the public). Although the fact of whether HLF really is or isn’t a pyramid scheme will determine if Ackman’s $0 price target is ultimately hit, any negative PR that reduces the number of incoming reps should have an impact on the future sales of the company which is something that a current balance statement or last quarter’s income statement just doesn’t reflect.

Remember that the current short entry was based largely off the charts (technical analysis) and everything mentioned above is fundamental analysis, or more so my prediction of why the fundamentals for this company are likely to change going forward. With that being said, my stop on the trade remains on a move above 45.10 as the charts trump fundamentals IMO, especially when trading. However, based on my negative longer-term fundamental outlook on HLF, I may likely add to my position going forward and quite possibly add additional downside targets to the trade if it starts to pan out. If interested, you can click here to see a list of some of the MLM companies doing business today. This list also includes some other now defunct MLM companies, such as Metabolife, that have been dissolved. This list does not include what I remember to be one of the largest MLM schemes, which, at least in the circles I travel, reached an almost frenzy “you must get in NOW!” pitch back in the mid-90’s. That was Excel Communications, which ended up giving the shaft to their sales reps, particularly those that got in at the bottom (aka- the “base” of the pyramid). As per Wikipedia: On November 1, 2004, VarTec Communications (the parent corporation of Excel) unexpectedly filed for Chapter 11 bankruptcy protection. Excel sought to be released from its contracts with its independent representatives. This allowed it to continue to receive revenue from its large base of installed customers without paying eternal commissions to the franchisees. Excel continued to operate but ceased to be a multi-level marketing company. Although it created a lot of cash to pay creditors, it was seen as shortsighted by the franchisee association since it removed the main source of sales and customer loyalty.