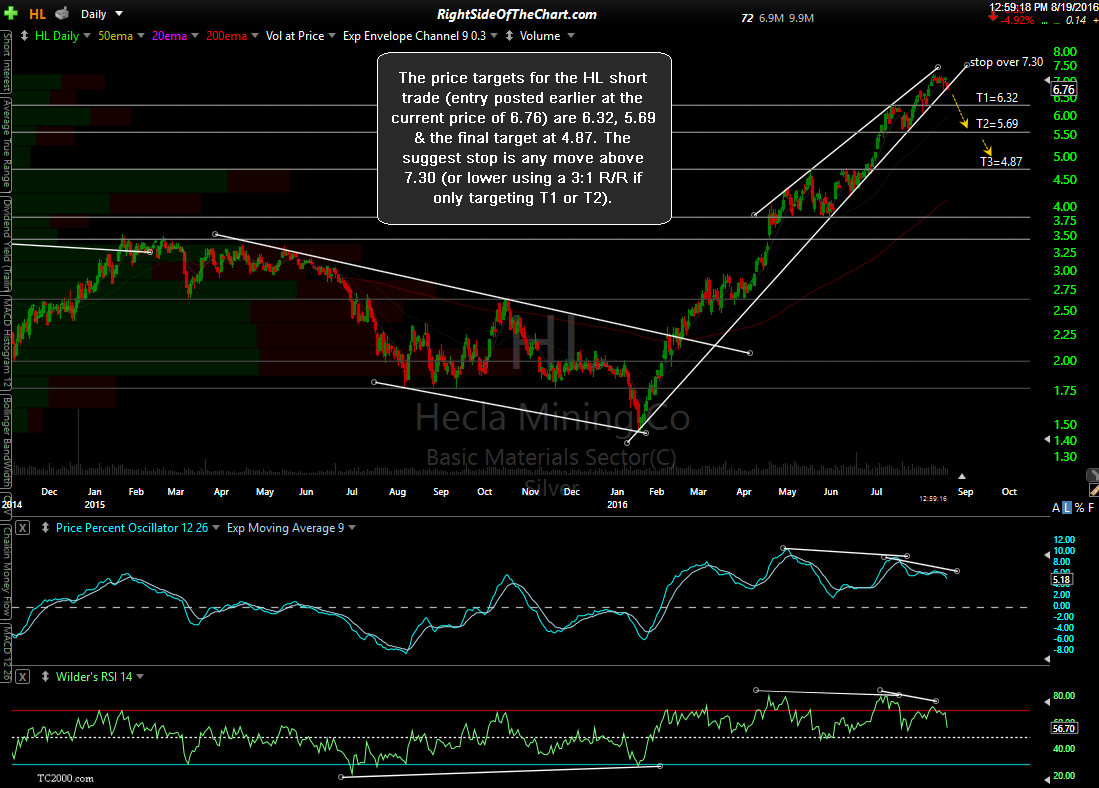

The price targets for the HL (Hecla Mining Co) short trade (the entry posted earlier while trading at the current price of 6.76) are 6.32, 5.69 & the final target at 4.87. The suggest stop is any move above 7.30 or lower using a 3:1 R/R if only targeting T1 or T2.

Keep in mind that I will most likely be adding several more individual gold & silver mining stocks as trade ideas along with GDX/NUGT and SIL (silver miners ETF). However, these stocks are extremely volatile & with SLV sitting right above a large gap (support) & the market poised for a pullback, gold & silver (along with the mining stocks) could experience one last thrust higher before succumbing to the bearish technical covered in yesterday’s video.

I have started adding some of the individual miners that appear to be breaking down today as official, active short trades today & will likely add more going forward. Due to the volatile nature & large price swings in these stocks, my own plan & suggestion for those also looking to position for a pullback in the mining sector would be to gradually scale into these positions (shorting a fractional position(s) to either individual miners and/or an ETF like GDX, NUGT, DUST, SIL, GDXJ, JNUG, JDST, etc…), and continuing to add at objective entries over the next week or so whether the sector moves higher OR lower, with stops calculated based on your average cost using a risk-to-reward ratio of 3:1 or better to your preferred price target(s).

For those looking to add exposure to the mining sector, make sure to factor in the above average gain AND loss potential on these stocks. One should also determine their target exposure to the sector (e.g.- 15% of their portfolio) in order to determine the position size on each trade, if scaling in, to allow room for additional trade ideas (unless trading one ETF vs. multiple individual stocks and/or ETFs).