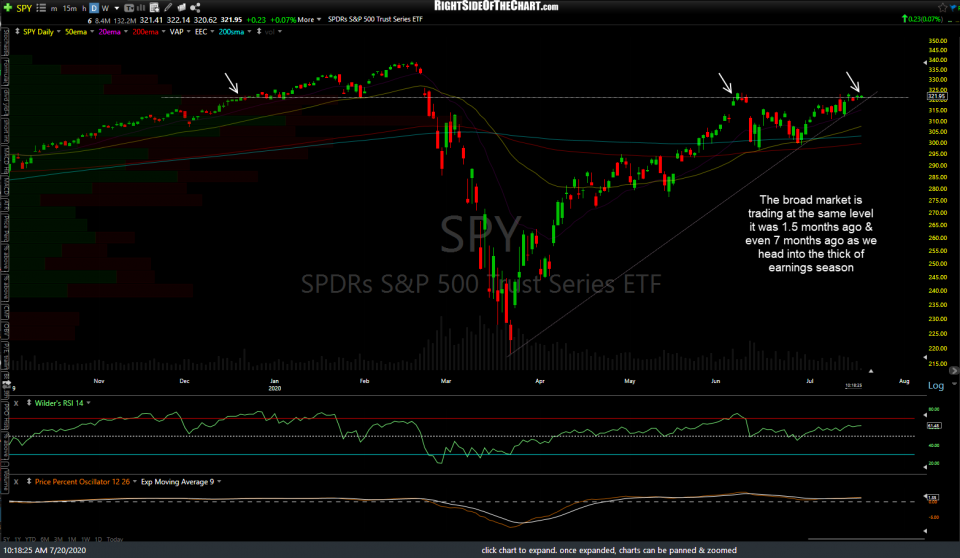

I’ve been struggling to find any new developments worth noting on the stock market today but I’ve come up blank as the broad market (S&P 500) continues to trade within a sideways trading range for nearly 2 months now, trading as the same level today as it was 6 weeks ago & even 7 months ago, for that matter.

Some of the potential market-moving companies scheduled to report this week are IBM, LMT (Lockheed Martin), KO (Coca-Cola), UAL (United Airlines), TSLA (Tesla), MSFT (Microsoft), INTC (Intel), TWTR (Twitter), T (AT&T), VZ (Verizon), & AXP (American Express), with a slew of additional big earnings reports to follow next week.

Personally, I like to keep things light during peak earnings as the market is prone to unpredictable gaps in either direction (due to the fact nearly all companies report before or after market hours) and the number of whipsaws/false breakouts, tends to spike as a result of the volatility & unpredictable gaps surrounding peak earnings.

I’ll be away from my desk most of today & will reply to any questions or comments later today. I’ll post any significant developments or any potential trading opportunities that I happen to come across this week, including any post-earnings “bounce-trade” opps, which are stocks that have an unusually large move immediately following earnings that brings the stock down to a key support level or a sharp rally into a very well-defined resistance level. Those type of setups are often good for a quick bounce or pullback trade, offering objective entries at the support or resistance level with stops set just below or above.