GOOG could provide a quick bounce trade as it has fallen quite a bit (i.e.-near-term oversold) to make this 5th tag of the uptrend generated off of the mid 2012 lows. (Daily chart below):

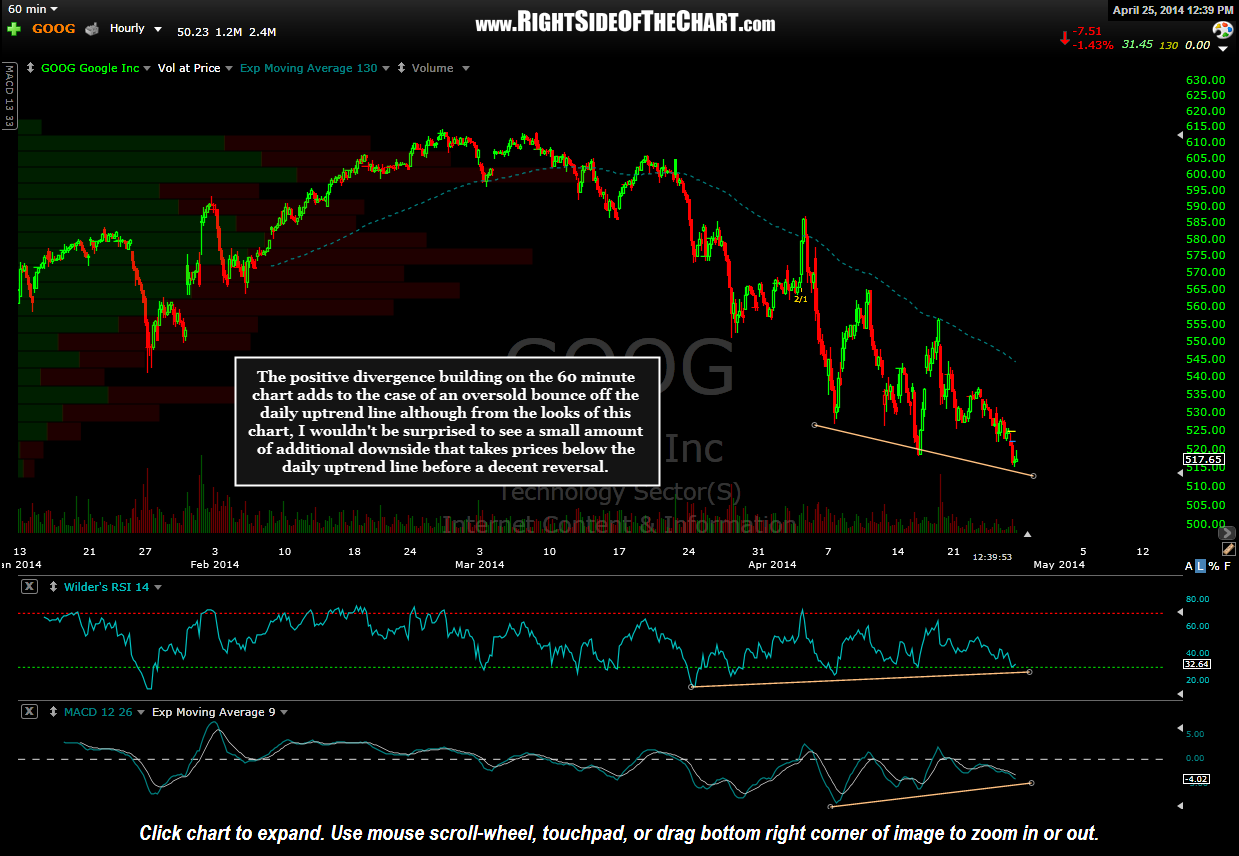

The positive divergence building on the 60 minute chart adds to the case of an oversold bounce off the daily uptrend line although from the looks of this chart, I wouldn’t be surprised to see a small amount of additional downside that takes prices below the daily uptrend line before a decent reversal. Overshoot of the daily trendline or not, I just took a long position in GOOG as much as a hedge to a QQQ short position as it is a bounce trade. Normally I have my price targets & stop levels identified before entering a trade but in this case, in particular because this partially a hedging trade, I will make those determinations depending on how the QQQ trades into early next week. GOOG will be added as both an Active Long Trade & a Long Trade Setup here around the 517.65 level.