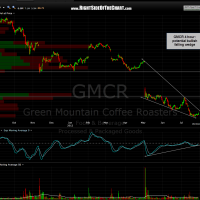

the GMCR long is playing out as expected for now so i have added some targets to the original 15 min chart (zoomed out to a 30 min chart below to better show those resistance/target levels). i also added a 4 hour chart below for longer-term traders who might have entered as a bottoming play as per the previous post. shorter-term traders might consider raising stops to just below the 18 level..

i continue to be very selective with longs as i believe the global central banks’ “jawboning induced rally” last week will be short-lived but with that being said, there are some decent looking patterns out there which can be used as either “pure plays” on the long side or as hedges to a net short portfolio. we are quickly approaching the top of that symmetry range on the NDX/QQQ so let’s see if the market turns back soon or if somehow manages to break above the top of that channel.