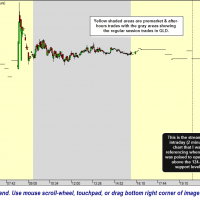

I didn’t hit me until I saw the Russian/Ukraine-induced reversal in GLD a few minutes ago when I checked the 60 minute chart on GLD that I had mistakenly listed the support on GLD which gold was likely to find support at earlier today. In the post that I drafted shortly before the open today I had mistakenly referred to the 124.40 support level in GLD as the 125.40 support level. I had been watching gold futures and the streaming intraday chart of GLD (shown below) and in a rush to try and get that post out as close to opening bell as possible, as I was expecting a likely reversal off the 124.40 area, I had mistakenly referred to it as 125.40 and also mistakenly added that level to the updated 60 minute chart even though GLD was trading about $1 below that level at the time as shown here in the intraday chart.

- GLD 60 minute Aug 15th 2

- GLD 2 minute with AH trades

Obviously the reports of an incident with that Russian convoy in the Ukraine that hit the headlines around the time GLD bottomed today at 124.42 certainly gave some tailwinds to the bounce off that level today. Call it lucky timing or the charts playing out (or a little of both) but so far, we are now looking at a successful backfill of that large Aug 6th gap that took GLD clearly out of that 60-120 minute bullish falling wedge pattern. From here, a break above the recent highs of 126.81 would be the next buy signal in GLD while a break below the 124.40 support and especially the 123 support level be bearish.