Ciao from the beautiful Sorento Coast in Italy! I haven’t had a spare minute to sit down & review the charts since starting vacation until now & just wanted to fire off a quick update on the precious metals & miners before shutting down as it’s late here.

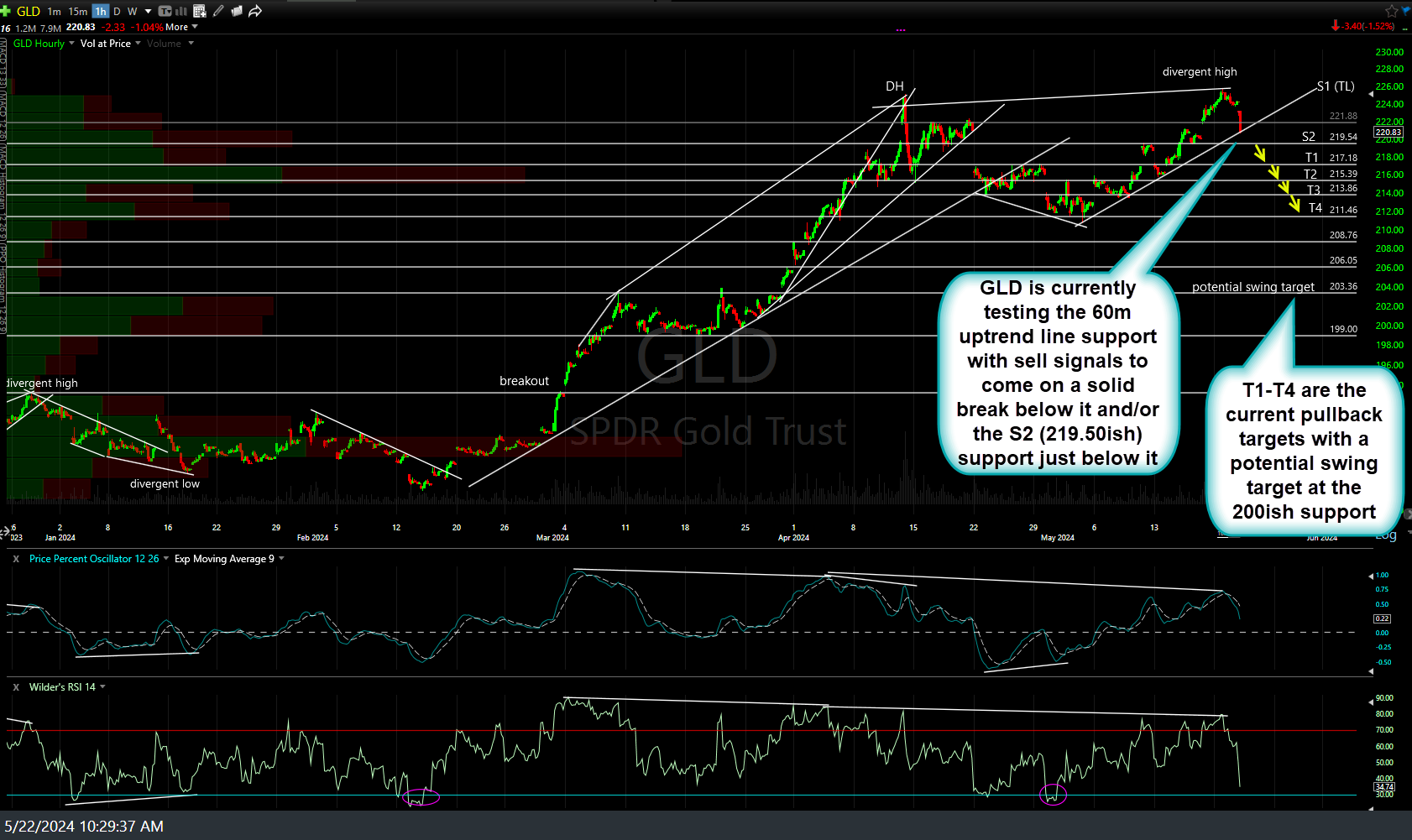

GLD (gold ETF) hit T4 (final price target & good support) with positive divergences, (still) offering an objective time to cover gold, silver and/or GDX shorts & go long with stops somewhat below. Initial (May 22nd) and updated 60-minute charts below.

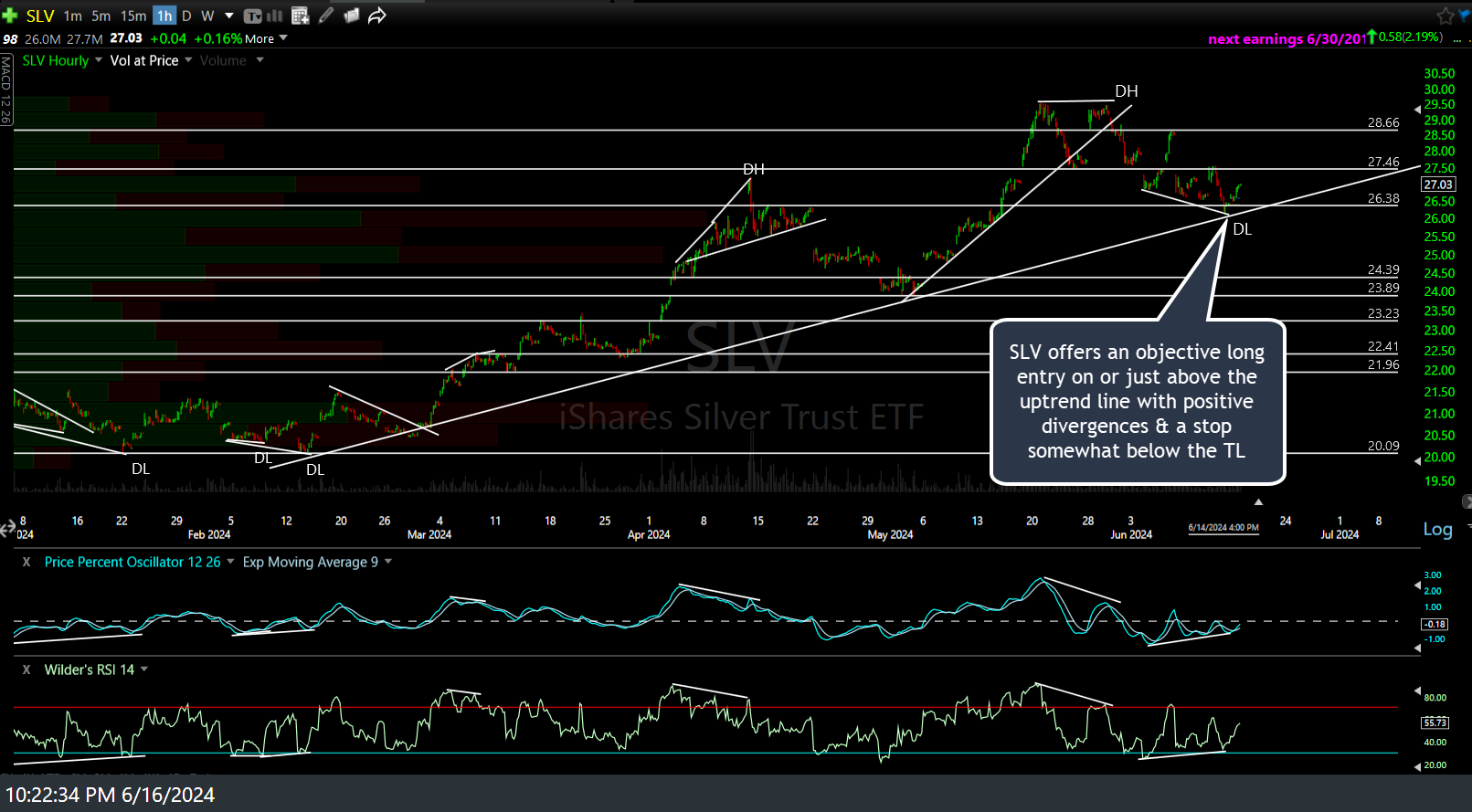

Likewise, SLV (silver ETF or /SI, silver futures) also offers an objective long entry here at or just above the uptrend line support that was hit along with GLD hitting the final target. 60-minute chart below.

GDX dropped 9% since the short entry about a month ago & although reversing just shy of its final target, based on the fact that GLD has hit key support/final price target with SLV also hitting uptrend line support, both with positive divergences to boot, it only seems prudent to either cover the short, lower stops (if holding out for additional downside) or reverse to a long position with stops somewhat below last week’s lows on both gold & silver. Initial (May 22nd) and updated 60-minute charts below.

Further supporting the case for a rally, should the aforementioned support levels in gold & silver hold with those positive divergences playing out for a trend reversal, EUR/USD has just hit the 1.066ish support with positive divergences as well. As recently (and frequently) highlighted, EUR/USD has a strong positive correlation to gold & silver. 60-minute chart below.

I wish I had time to go over more charts but it’s very late here (Sunday night) & our schedule is tight again starting early tomorrow morning so I will do my best to post some more analysis before I return home at the end of the week (Friday, June 21st).