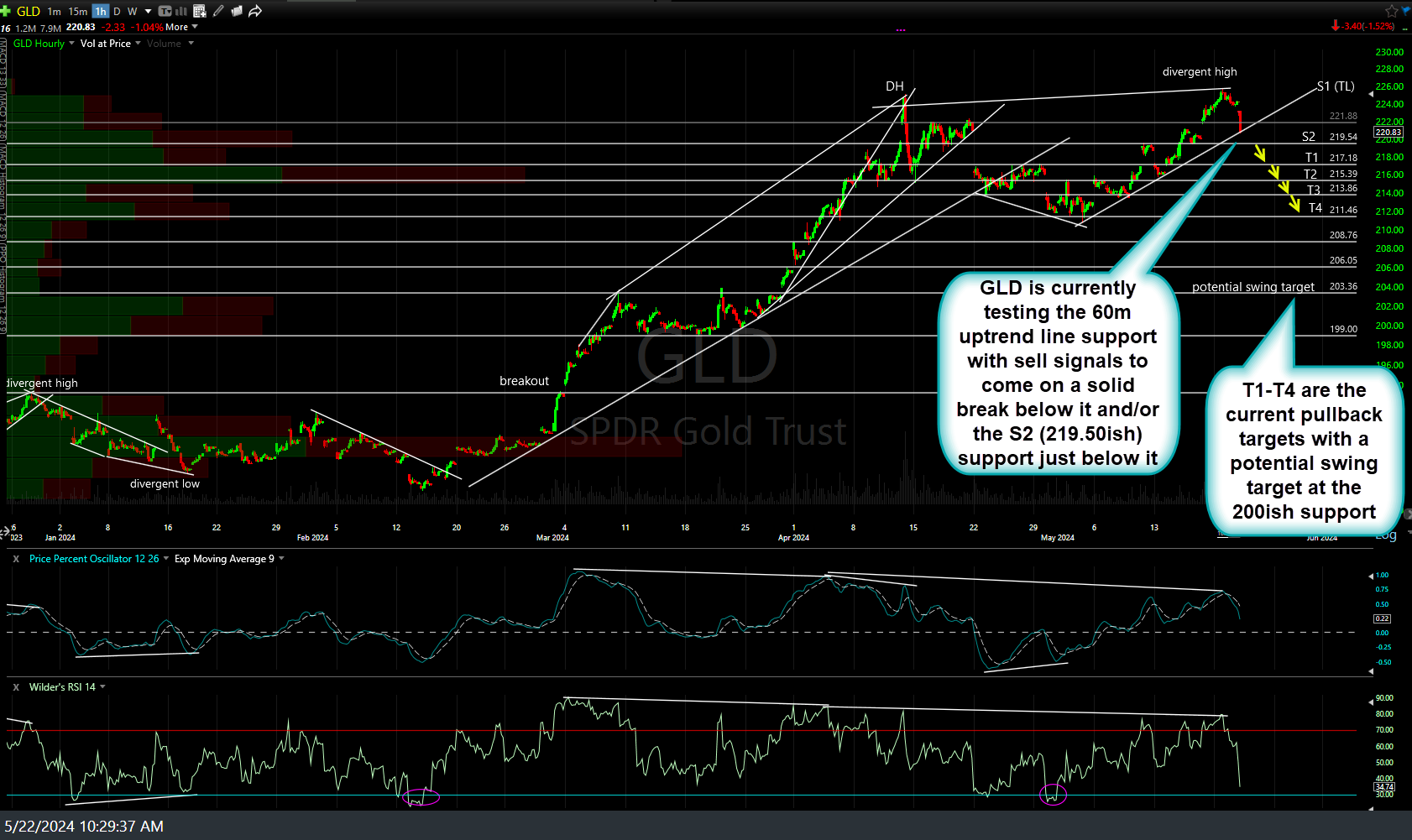

GLD (gold ETF) is currently testing the 60-minute uptrend line support with sell signals to come on a solid break below it and/or the S2 (219.50ish) support just below it. T1-T4 are the current pullback targets with a potential swing target at the 200ish support.

GDX (gold miners ETF) has broken below its comparable 60-minute uptrend line/rising wedge pattern & will trigger an objective short entry on a solid break below S1 (1st support) around 35.78 ALONG with a breakdown of the 60-minute rising wedge pattern on GLD. T1-T3 are the new pullback targets (the previous setup last month tested & bounced off, but never took out S3) with a potential max. target zone around 30-31.

To reiterate, these are trade SETUPS which are potential trade ideas pending the necessary sell signals/entry criteria, not actionable or active trades at this time as both GDX & especially gold are current trading at support.