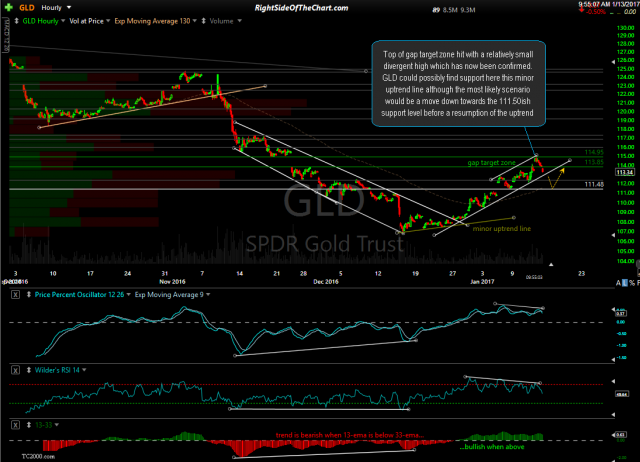

Since the previous front page update & scenario on GLD posted just before the new trading year kicked-off (first chart below), GLD (gold ETF) went on to hit the top my gap target zone while putting in a relatively small divergent high which has now been confirmed via a bearish crossover on the 60-minute MACD. GLD could possibly find support here this minor uptrend line although the most likely scenario would be a move down towards the 111.50ish support level before a resumption of the uptrend.

- GLD 60-minute Jan 1st

- GLD 60-minute Jan 13th

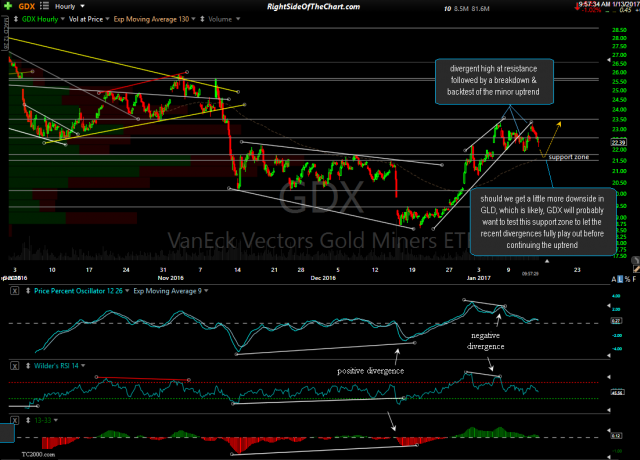

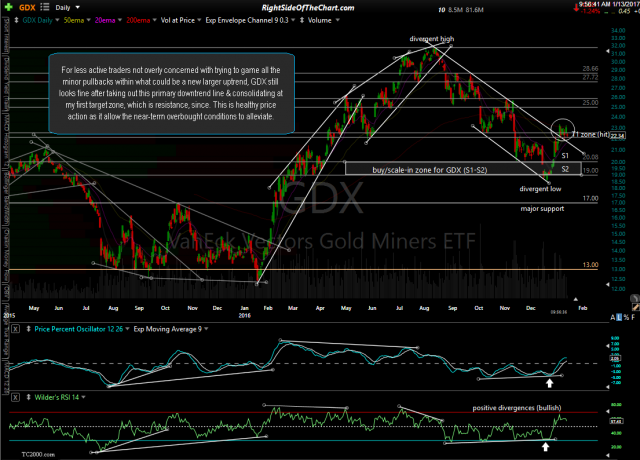

GDX recently made a divergent high at resistance followed by a breakdown & back-test of the minor uptrend line on the 60-minute time frame. Should we get a little more downside in GLD, which is likely, GDX will probably want to test this support zone to let the recent divergences fully play out before continuing the uptrend. For less active traders not overly concerned with trying to game all the minor pullbacks within what could be a new larger uptrend, GDX still looks fine after taking out this primary downtrend line & consolidating at my first target zone, which is resistance, since. This is healthy price action as it allows for the near-term overbought conditions to alleviate.

- GDX 60-minute Jan 13th

- GDX daily Jan 13th