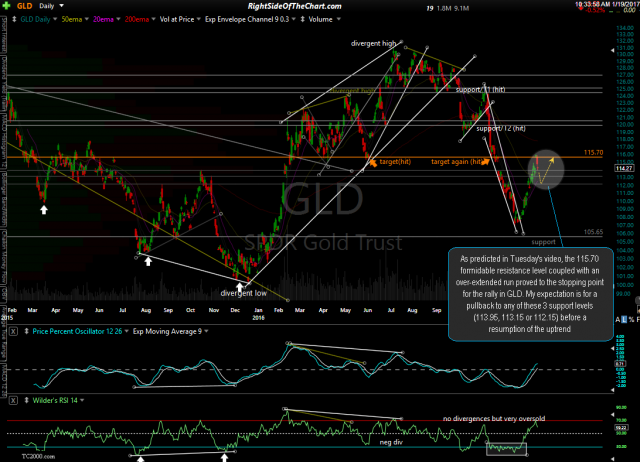

As predicted in Tuesday’s video, the 115.70 formidable resistance level coupled with an over-extended run proved to the stopping point for the rally in GLD. My expectation is for a pullback to any of these 3 support levels (113.95, 113.15 or 112.15) before a resumption of the uptrend. The first chart is a screenshot taken from Tuesday’s video discussing my expectation for a pullback in GLD while it was trading just a few cents from where it topped that day (purple lines highlighted the pullback scenario) followed by the updated chart showing that the first of 3 potential pullback targets/support levels (113.95) has now been hit. As such, a minor reaction off this level is likely although I’m leaning towards another thrust down towards either or both of the next two support levels at this time.

- GLD video screenshot from Jan 17th

- GLD daily Jan 19th