I was asked my current thoughts on gold, silver & the mining stocks today along with the fact that the Bollinger Bands are tightening and my reply was this:

Not much to add to what I posted on Tuesday which was that the price action in both GLD & SLV that day has near-term bearish implications on both the metals and the miners. I’d like to see how the week finishes out before making any decisions on my positions but with the BB pinching and the Tuesday’s bearish price action in the metals, the possibility for a flush-out move to the downside is certainly elevated at this time.

Although I often will use price weakness to scale into or add to an existing position, I did not nor will not add any more exposure to the mining sector since the price action on Tuesday was bearish with GLD breaking below that large symmetrical triangle & the recent 60 minute bullish falling wedge breakout in SLV failing impulsively. Basically, I’m watching to see how the metals close out the week and I plan to post some updates to the metals and miners before the close tomorrow.

I realize that trading ranges & especially moves against your positions can be very frustrating. For a while now I have been reiterating a few points, namely that 1) The miners will ultimately follow the metals and 2) The miners remain in a relatively large trading range that started with the large gap higher back on June 19th and 3) Although the near-term picture became bearish on Tuesday with the breakdown below the large symmetrical triangle pattern in GLD (4-hour chart) and the failed breakout of the bullish falling wedge in SLV (60 minute chart), the longer-term bullish case in both gold & the mining stocks remains intact for now.

On the first point, I have often discussed in the past how the mining stocks are basically just a leveraged play on gold prices and with the recent breakdown in gold, including the price weakness that proceeded that breakdown (along with the fact that the miners were relatively strong despite the softness in the metal prices) GDX is simply playing a game of catch-up to the downside in recent trading sessions and most likely will continue to do so until gold prices start to firm up. Regarding the second point, the recent multi-month trading range in GDX, prices have just started to enter the top of the June 19th gap as I type which makes the chances of a complete backfill of the gap fairly likely at this point. If so, that would bring GDX to around the 24.78 area (bottom of the gap) which has been labeled a S3 on the previously posted 60/120 minute GDX charts and one of the likely reversal targets for this pullback.

As also mentioned previously, we still have a few more significant support levels below on both GLD & GDX and I just can’t say with a high degree of confidence which one, if any, will be the final stopping point for the current short-term downtrend in gold & the mining sector. However, as stated before, my most recent buy-back into the mining stocks was positioning for a likely trend trade in gold & the mining sector. In other words, although my previous trades on the miners were swing trades, this most recent positioning is an attempt to play the long-game in the miners and therefore, I am willing to use fairly liberal stops on those positions. Of course, my trading plan should have no bearing on what anyone else does. Every trader & investor must decide what to buy, when to buy it and when to sell it, both if profitable as well as where to stop out if the trade goes against you.

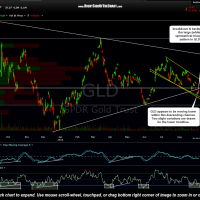

The charts below are the updated 4-hour chart of GLD showing how prices made a perfect backtest of the recently broken triangle pattern before turning lower, i.e.- a successful backtest of the pattern. I’ve also added what could be shaping up to be a descending price channel (yellow lines) in which I could easily see prices riding down on the way to the aforementioned 119.50ish support level. Such a move would likely take the miners down to the S4 support level although I wouldn’t be surprised to see the miners mount a substantial bounce off the S3 level (24.78ish) as 1) they are becoming very oversold in the near-term & 2) we have some potential bullish divergences in place on the 60 minute chart at this time.

- GDX 60 minute Sept 4th

- GLD 4 hour Sept 4th

Bottom line: I continue to sit tight, opting not to add to any of my precious metals or mining positions until/unless I see some decent signs that the near-term downtrend may have run it’s course and that the key longer-term supports in gold, silver* & the miners has held. (*I could easily see a brief break below the mid 2013 & 2014 lows in silver/SLV as a flush-0ut move before a meaningful reversal). Unlike some traders, I don’t mind averaging down on a position as long as that was my original plan (a scale in strategy). However, I feel strongly about the fact that a trader or investor should never average down on a losing position just to lower their cost basis. This holds especially true if the charts no longer clearly support a case for owning the position OR if you had already reached your maximum allotment to that particular position or sector. I will continue to post any significant developments as I notice them. Once again, always use position sizing & stops that are appropriate with your unique risk-tolerance and trading objectives, especially with the extremely volatile mining stocks.