GDX (gold miners ETF) is now coming up on my 21.84 price target posted on March 22nd (first 120-min chart below) where a reaction is likely before a resumption of the uptrend.

- GDX 120-min May 22nd

- GDX 120-min May 31st

My preferred scenario, as outlined on the daily chart below, would have GDX pulling back next week for a test or near-backtest of the top of today’s gap, followed by the next leg higher toward the 23.00 target area. Whether on not we get a tradable pullback & test of today’s gap will most likely depend on whether the stock market continues lower or rallies next week as continued selling in the stock market would most likely keep a bullish bid beneath gold & the gold mining stocks.

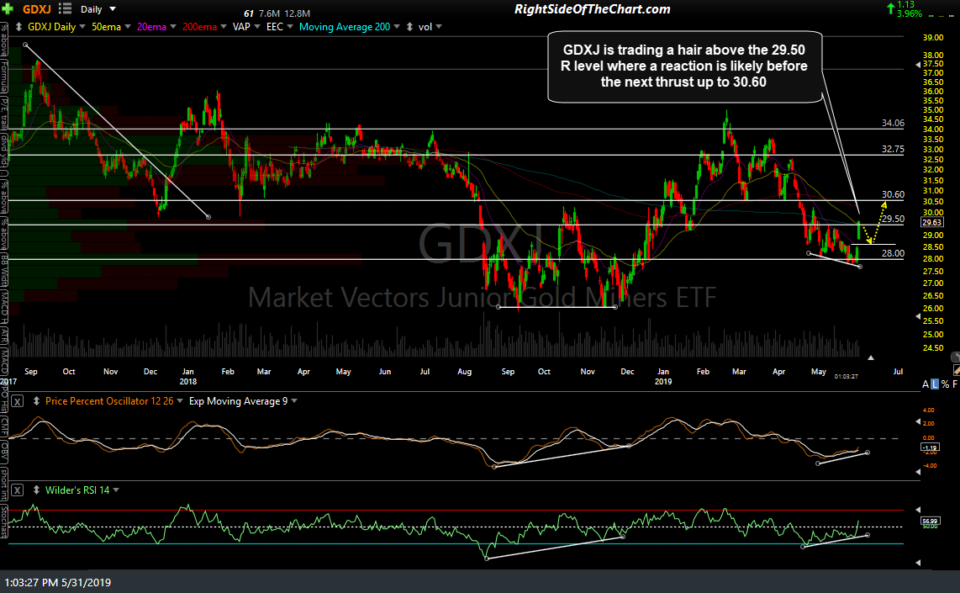

Member @btm in the trading room inquired about price targets on JNUG (3x bullish junior gold miners ETF), which can be correlated to the price targets on this chart of GDXJ (1x, non-leverage junior gold miners ETF) which is better used for charting as it does not suffer the decay that the 3x leveraged JNUG & JDST are prone to. GDXJ is trading a hair above the 29.50 R level where a reaction is likely before the next thrust up to 30.60. While that is my preferred scenario at this time, a pullback of that magnitude is largely contingent on the bounce scenario for the stock market next week. Should the stock market continue to fall next week, gold & the mining stocks are likely to continue to rally.