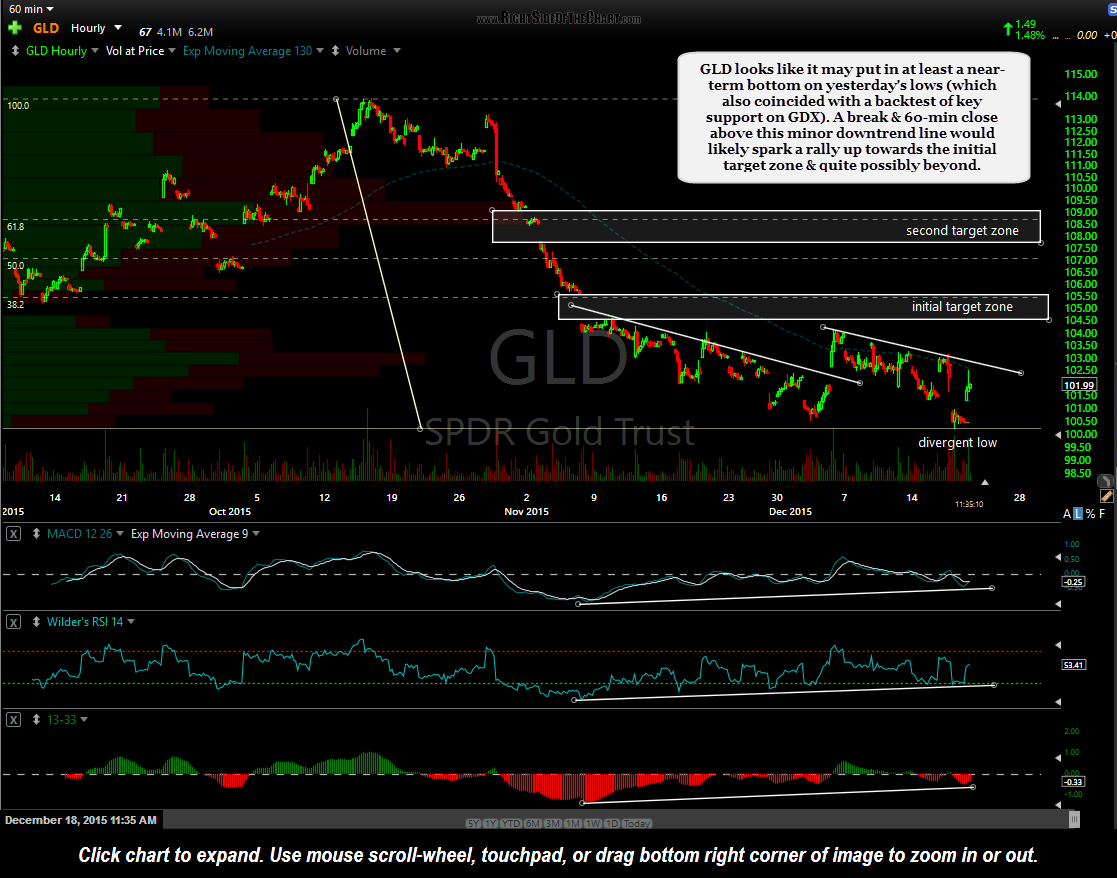

GLD (gold ETF) looks like it may have put in at least a near-term bottom on yesterday’s lows (which also coincided with a backtest of key support on GDX). A break & 60-min close above this minor downtrend line would likely spark a rally up towards the initial target zone & quite possibly beyond.

So far, GDX bounced as expected off the key 13.30ish support level. While one more thrust lower within the wedge is certainly possible, a solid break above the wedge would likely spark a rally up towards the 15.15 area. As such, a new price target, T3 at 15.10 has been added. While yesterday’s tag of support or even where GDX is currently trading offered/still offers an objective long entry or add-on to an existing position, I would suggest a DUST short over a NUGT long for swing traders or trend traders that are looking to position for what could morph into a multi-month+ trade, should gold & the mining sector start to show evidence that a more lasting bottom has been put in place (vs. just one more in a long string of very profitable short-term counter-trend trades that we’ve traded in the miners over the last couple of years).

There’s really no way to say with confidence when a lasting bottom in gold & the miners is in place or looks likely to be forming until the charts reflect that. That might be 20% or more off the final lows in GDX & gold but with every new low in this already extended bear market, we are one day closer to a bottom. Hence, I’ll keep trading the miners long & short, primarily trading off chart patterns, support & resistance, etc.. based off the intraday charts but when it looks like a long-side trade has the potential to last for more than just a few days, I’ll typically opt to short DUST in lieu of a NUGT long in order to have the decay of these highly volatile, 3x leveraged ETFs work for me, instead of against me. As such, DUST will also be added as an Active Short Trade at this time (in addition to the GDX & NUGT longs). However, due to limitations with how each post is assigned both symbol tags and categories, DUST will appear under the Active Long Trade ideas. Essentially it is a net long position anyway, being that a short of a 3x inverse ETF gives you long exposure to that sector.