GFI (Gold Fields Ltd) was one of my top picks covered in the July 30th Gold & Gold Mining Sector video. At the time, had pointed out the nice basing pattern that GFI had formed with the next buy signal to come on a break above the 4.38-4.40 resistance level, which GDI has clearly taken out this week. This gold mining stock has shown some nice relative strength lately having gained 16% since that video was posted less than a month ago while the gold mining sector (GDX) has just chopped around since then and is currently trading slightly below its July 30th close.

- GFI daily 7-30 screenshot

- GFI daily Aug 28th

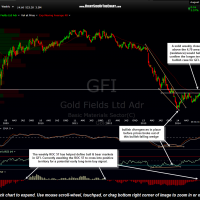

- GFI weekly Aug 28th

GFI was added as a Long-Term Trade setup when the video was published and following the breakout above the 4.40 resistance level, is now considered an Active Long-term Trade. However, despite the recent bullish price action in GFI, I did want to point out that GFI is now approaching a key long-term resistance level that comes in around the 4.70 area as shown on the weekly chart below. Any solid weekly close above that level will trigger the next long-term buy signal for an entry or add-on to an existing position in GFI. Of course, as always, it is imperative to manage your positions in the individual mining stocks along with the charts of both gold ($GOLD/GLD) & the gold mining sector ($HUI/GDX) as the success or failure of these trades, especially when positioning as long-term swing or trend trades, will largely depend on where gold prices are heading.

Bottom line: Although some gold & silver stocks have outperformed the mining sector and may trigger buy signals as they break out of bullish chart patterns or above key downtrend lines or resistance levels, gold & silver, although still looking bullish from a longer-term perspective, remain in somewhat precarious technical positions at this time and still have some work to do in the near-term in order to help solidify the case that a new bull market is underway. Therefore, make sure to use stops and position sizing commensurate with your own trading style & risk tolerance when trading the miners along with proper diversification, particularly if trading individual names vs. the diversified mining ETFs such as GDX, GDXJ, & SIL.