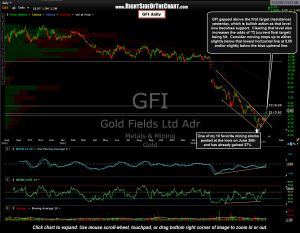

Here’s the updated daily chart for GFI, another one of the top 10 mining picks from June 26th. In the last update on GFI on July 11th, these two price target (5.62 & 6.24) were added to the chart. Yesterday GFI gapped above the first target, which is bullish price action as that was a key resistance level which is now in the rear view mirror. This increases the odds of T2, the current final target at 6.24 being hit soon.

Here’s the updated daily chart for GFI, another one of the top 10 mining picks from June 26th. In the last update on GFI on July 11th, these two price target (5.62 & 6.24) were added to the chart. Yesterday GFI gapped above the first target, which is bullish price action as that was a key resistance level which is now in the rear view mirror. This increases the odds of T2, the current final target at 6.24 being hit soon.

As of now, GFI is up about 27% from the lows back on June 26th and as such, the odds for a near-term overbought pullback are quickly rising. Longer-term traders might use any pullbacks to support as opportunities to add to their position(s) while shorter-term traders might look to start booking full or partial profits by scaling out of their mining stocks, depending on their average cost, imbedded gains, trading plan, etc… As my strategy was to use that previous discussed “strategic scale in strategy” (adding lots on the dips along the way), as of today I am starting to use the same strategy in reverse to start booking some profits (selling partial positions on the rips), particularly as those stocks begin to hit my initial profit targets.