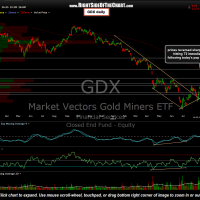

GDX closed just shy of my second target (T2) yesterday and then popped higher at the opening to hit that target to basically the cent before reversing. As I never try to milk every last penny from a trade, I had sold the last of my mining stocks before the close yesterday and even reversed the trade with a very modest short. I know at least one follower of the site also established a short position yesterday (nice entry so far, DK) and so here’s a 60 minute chart with some likely pullback targets and an uptrend line to watch.

With the recent momentum, volume & interest in the mining stocks very strong, coupled with the fact that DUST (3x short miners etf) is highly prone to price decay if held for more than a few days (ditto++ for the GDX put options, should GDX move higher), this reversal from long to short was only intended for a quick pullback trade likely measured in hours or days, not weeks. As of now, I’m eying the 28.75ish area for a possible target although I may decide to extend or shorten that target. As far as stops, I’m willing to allow for a slight overshoot of the T2 level (today’s highs) but not by very much. Updated daily & 60 minute charts.

Note: GDX remains an Active Long Trade for now as the longer-term charts remain constructive. Any short trade, as a counter-trend trade should only be considered by aggressive & experienced traders. The main point that I was trying to impress yesterday upon stating that I had booked profits and reversed the trade was that both GDX & SIL were approaching very significant resistance levels while extremely overbought in the short term. These stocks are still just recently coming off extreme oversold levels on the longer-term (daily, weekly, & monthly) time frames and as such, could very well continue to move higher from here. However, my take is that these stocks will likely need to consolidate around these current resistance levels for at least a few days/weeks before building the energy to make a sustained breakout and continue to move higher.