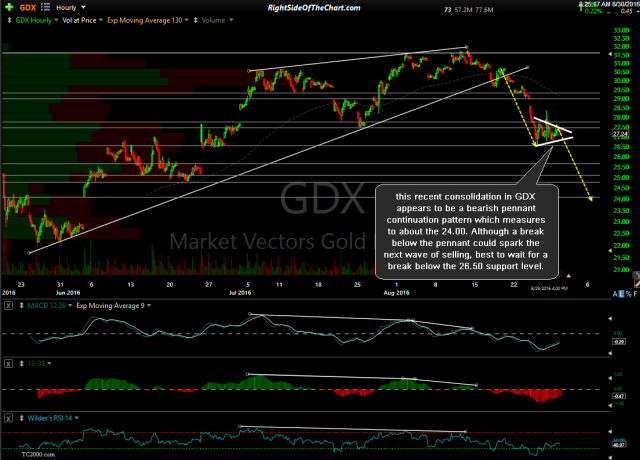

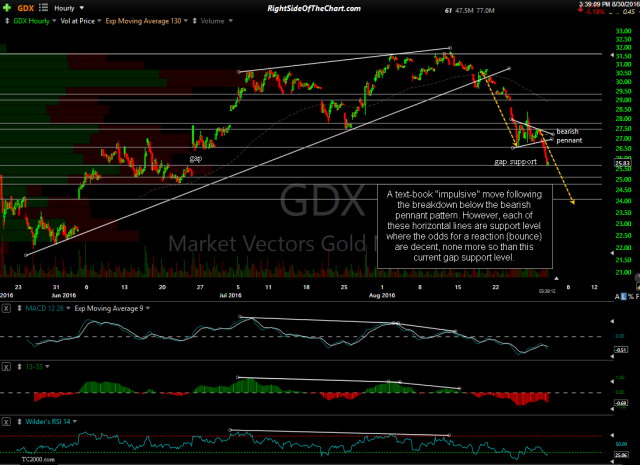

As a follow-up to the GDX update posted earlier today before the market opened, here’s the updated chart of GDX along with the chart posted in earlier this morning. GDX did go on to breakdown below both the bearish pennant continuation pattern as well as the 26.50 minor support just below & has recent hit the first of the support levels (25.65) on that 60-minute chart. That support level was set at the reaction high near the bottom of the large June 23/24th gap and as such, the odds for at a reaction off that moderate support level are quite elevated.

- GDX 60-minute Aug 29th close

- GDX 60-minute Aug 30th

With the closing bell ringing as I type, I’d have to say that while I can see the possibility for a little more upside following the bounce off that level so far carrying over into early trading tomorrow (GDX bounced a little higher since the screenshot above to close at 25.90), I’m still leaning towards more impulsive selling down to at least the first target on the GDX/NUGT short (or DUST long) of 24.85 & quite possibly to the top of the June 3rd gap around 24.00. The previous 4-hour chart (first one below) shows the timely entry on the GDX official short trade at the top of the recent bearish pennant/snap-back rally (while unofficially, it was covered as an objective short just off the highs). I’ve also added that 24.00ish support/potential target on the updated 4-hour chart (second below) for those wanting to hold out for additional gains beyond T1 but shy of T2 although the official price targets remain 24.85 & 22.28.

- GDX 4-hour Aug 26th

- GDX 4-hour Aug 30th