GDX (gold miners ETF) offers an objective long entry here now that the EUR/USD has hit my maximum pullback target. As such, GDX will be added as an Active Long Swing trade around current levels.

The sole price target at this time is T1 at 19.39 with a decent chance that additional price targets will be added if the charts of gold, GDX & the Euro/US Dollar continue to play out as expected. The maximum suggested stop for GDX will be a daily close below 17.50 with a suggested beta-adjusted position size of 0.80.

The first chart below is my EUR/USD 60-minute chart from August 15th calling for a bottom in the EUR/USD (i.e.- a top in the US Dollar). The EUR/USD did bottom from there, going on to immediately breakout above that bullish falling wedge followed the strongest rally of the year in the Euro/US Dollar as that also coincide with my bear trap scenario on the EUR/USD daily chart.

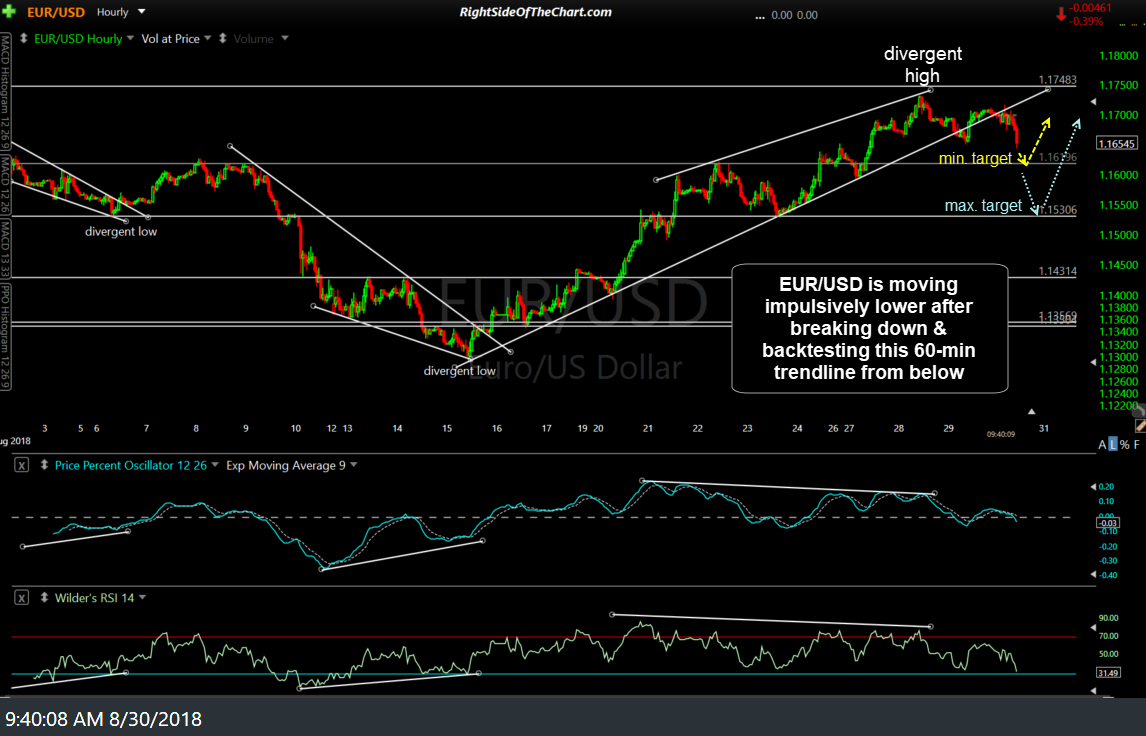

Following that rally, I started calling for a correction in the EUR/USD (i.e.- rally in the dollar) around the time the EUR/USD broke down from the 60-minute bearish rising wedge posted below back on August 30th, stating that would likely take the dollar sensitive gold & GDX down along with it.

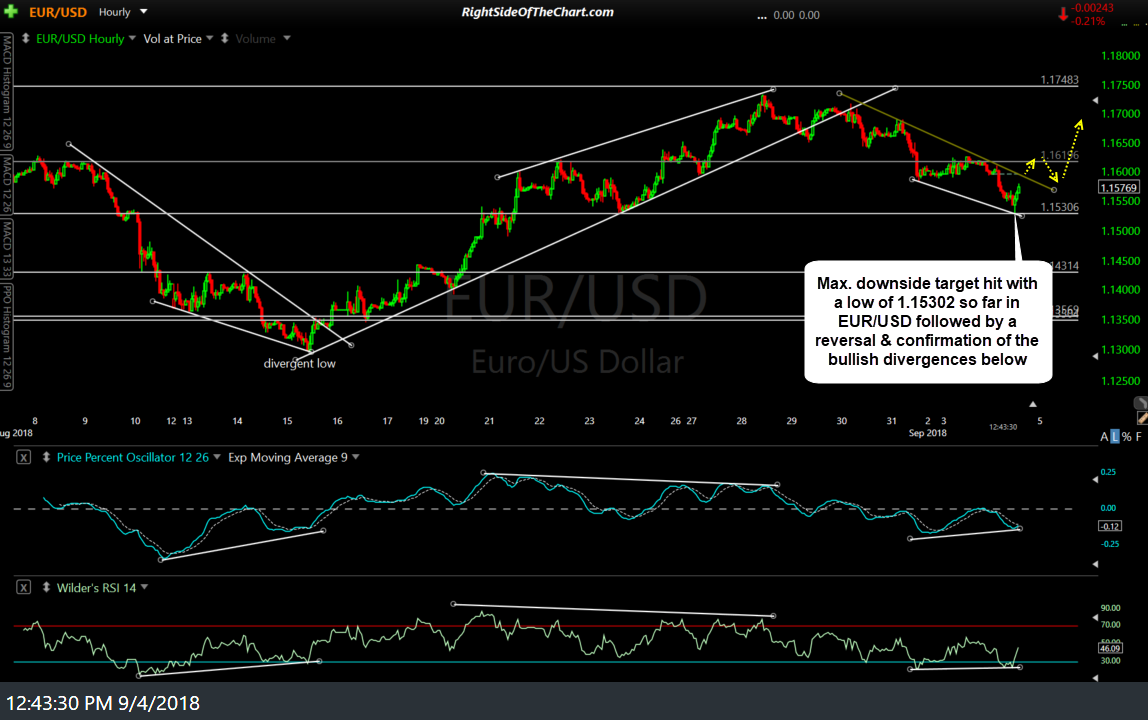

As of today, EUR/USD hit my maximum pullback target to the button (well, within 4 pips or 0.00004) so far with a low of 1.15302 before reversing sharply while also confirming the positive (bullish) divergences between price & the momentum indicators below.

While my Euro bear trap/US Dollar bottom scenario may or may not continue to play out, if it does, this GDX trade has the potential to morph into a multi-month & possibly a multi-year long-term trend trade.