The GDX (gold miners ETF) long swing trade slightly clipped the suggested stop of 21.90 yesterday for a 3% loss. I still expect a rally in the gold mining stocks & precious metals, despite the recent trendline break in gold & may add GDX back as another official trade soon.

Following the trendline break, GLD (gold ETF) has fallen to the fairly solid 120ish support level while oversold. Arrows on the RSI show ALL oversold readings in the past two years. The previous 5 oversold readings were all followed by substantial rallies & I see no reason why this time will be different (oversold + at support = objective long entry).

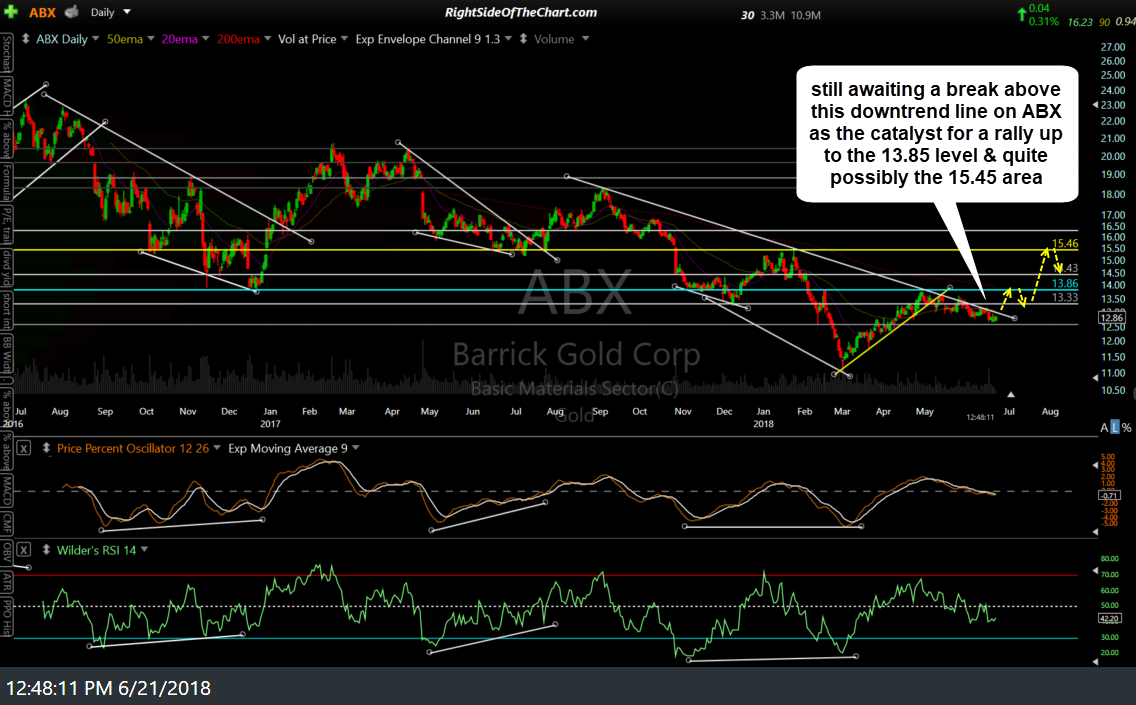

Member @jrandhawa had requested analysis GLD, GDX as well as ABX in the trading room. ABX still appears poised for a trend reversal & rally up to at least the 13.85 area & quite possibly as high as the 15.45 area with a buy signal to come on an impulsive breakout above this primary downtrend line, ideally with additional confirmation via a reversal in both GLD & GDX.