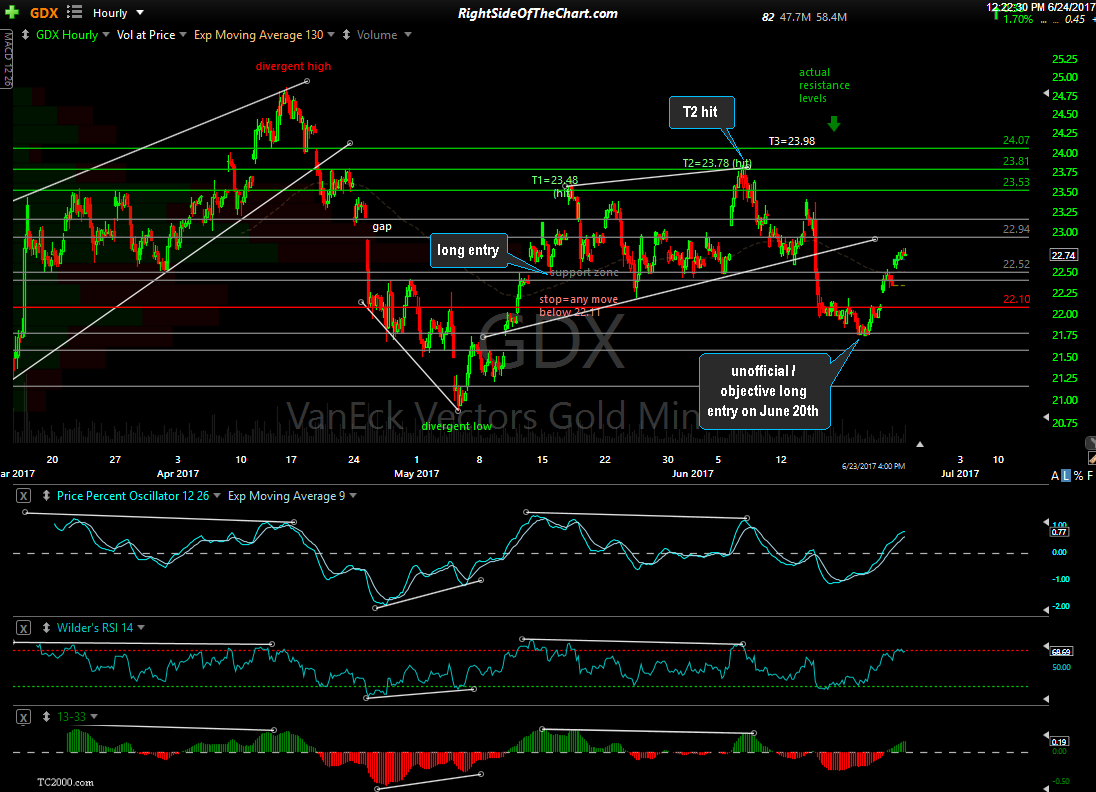

The GDX official Long Swing Trade was entered on May 15th, rallying from there to hit the 2nd price target, T2 at 23.78, for a 5.4% profit on June 6th. GDX stopped cold at that resistance level while also putting in a divergent high & went on to exceed the original suggested stop of any move below 22.11 (although it was suggested to raise stops when T2 was hit if not booking profits). Shortly after the maximum suggested stop was exceeded, both GLD & GDX fell to support levels that offered objective long entries once again, as highlighted here on June 20th. Both GDX & GLD immediately reversed from those levels with GDX rallying about 4½% since.

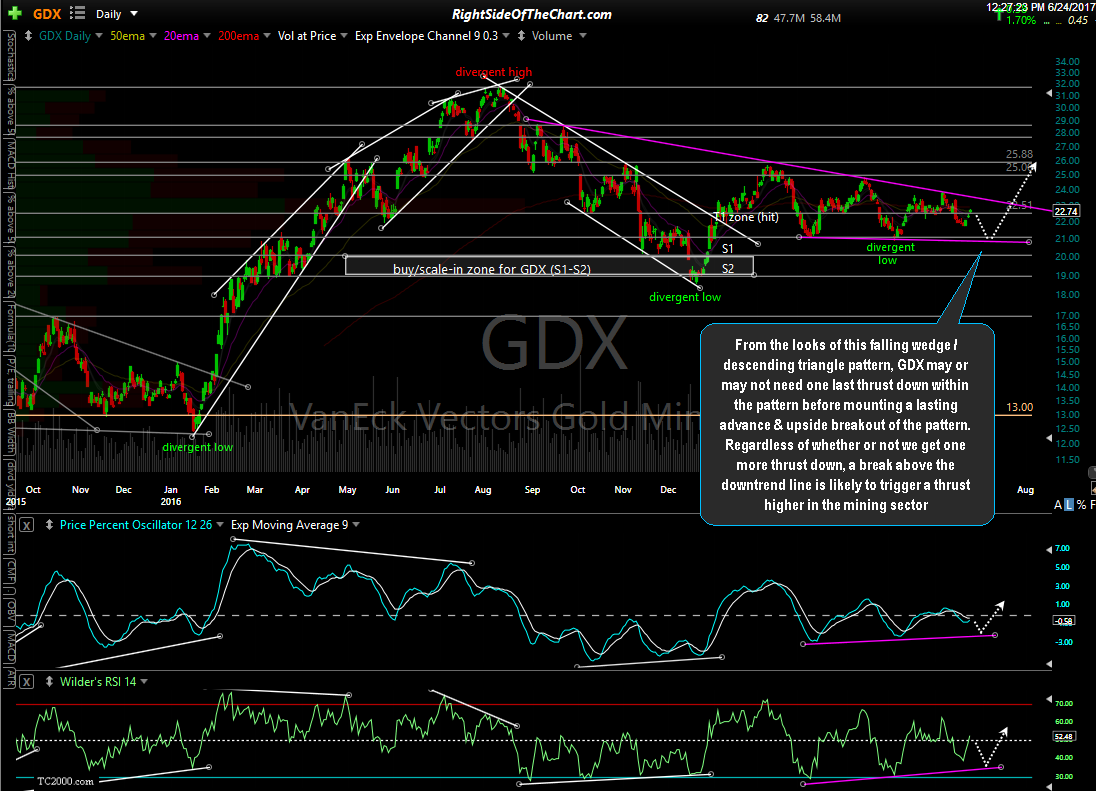

Regarding the intermediate-term outlook for the mining stocks, from the looks of this falling wedge / descending triangle pattern on the daily time frame, GDX may or may not need one last thrust down within the pattern before mounting a lasting advance & upside breakout of the pattern. Regardless of whether or not we get one more thrust down, a break above the downtrend line is likely to trigger a thrust higher in the mining sector.