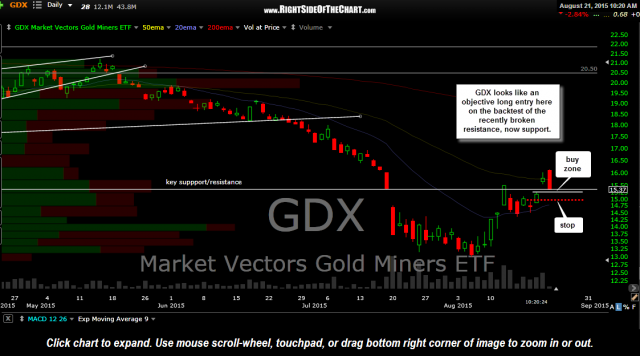

GDX (Gold Miners ETF) looks like an objective long entry here on the backtest of the recently broken resistance, now support. Ideal buy points from around the 15.40 area (current price 15.37) down to Wednesday’s high of 15.28 with a suggested stop below 15.00.

Personally, I’m leaning towards just a quick bounce, probably a just day trade via NUGT but plan to add some price targets, both near-term & longer-term, should GDX reverse or hold soon before exceeding the suggested stop of a move below 15.00.

GDX, NUGT & DUST will all be added as Active Long Trades here. Keep in mind that although DUST will appear under the Active Long Trade ideas, one would be short DUST in order to gain long exposure to the mining sector. A DUST short is best for those positioning for a potential swing or trend trade lasting more than a few days, ideally weeks to months.

There are a couple of ways to play this pullback-to-support trade on GDX:

- Enter here as a possible multi-week+ swing trade or even a longer-term trend trade/investment, following the recent bullish developments in gold, silver & the mining sector. (in which case, consider somewhat wider stops than those mentioned above). One could also short DUST (3x short miners ETF) as well in order to take advantage of the price decay suffered from the leveraged ETFs.

- Go long GDX via NUGT (3x long miners ETF) for a quick bounce trade off this initial backtest of support. That trade can be closed out today or within a few days at most.