I’ve studied the charts inside & out today, looking for something relevant to share but other than the fact that the broad markets followed through on yesterday’s breakouts (which so far, helps to confirm yesterday’s breakouts), I can’t find anything that has changed in the technicals since the market update video that was posted last night. Essentially, the price action over the last two trading sessions was clearly bullish & certainly skews the near-term outlook to bullish until & unless the gains over the last two days are faded, which would need to occur soon.

For the time being, the longer-term outlook for the equity market remains bearish & while I believe the intermediate-term bearish case still trumps the bullish case, that argument will start to erode should the markets continue higher in the coming days & weeks. I’ve been very cautious & extra selective on new trade ideas recently but will do my best to pass along anything that I come across that looks compelling, either as official or unofficial trade ideas.

Despite continued strength in equities & even a green close on GDX today, GLD (gold ETF) has once again close red for the sixth consecutive trading session since breaking down below the large bearish rising wedge on the daily time frame. It is worth noting that GLD came within 32 cents of my 116.00 target (less than 3/10ths of 1%) & now has positive (bullish) divergence in place out to the 15-minute time frame.

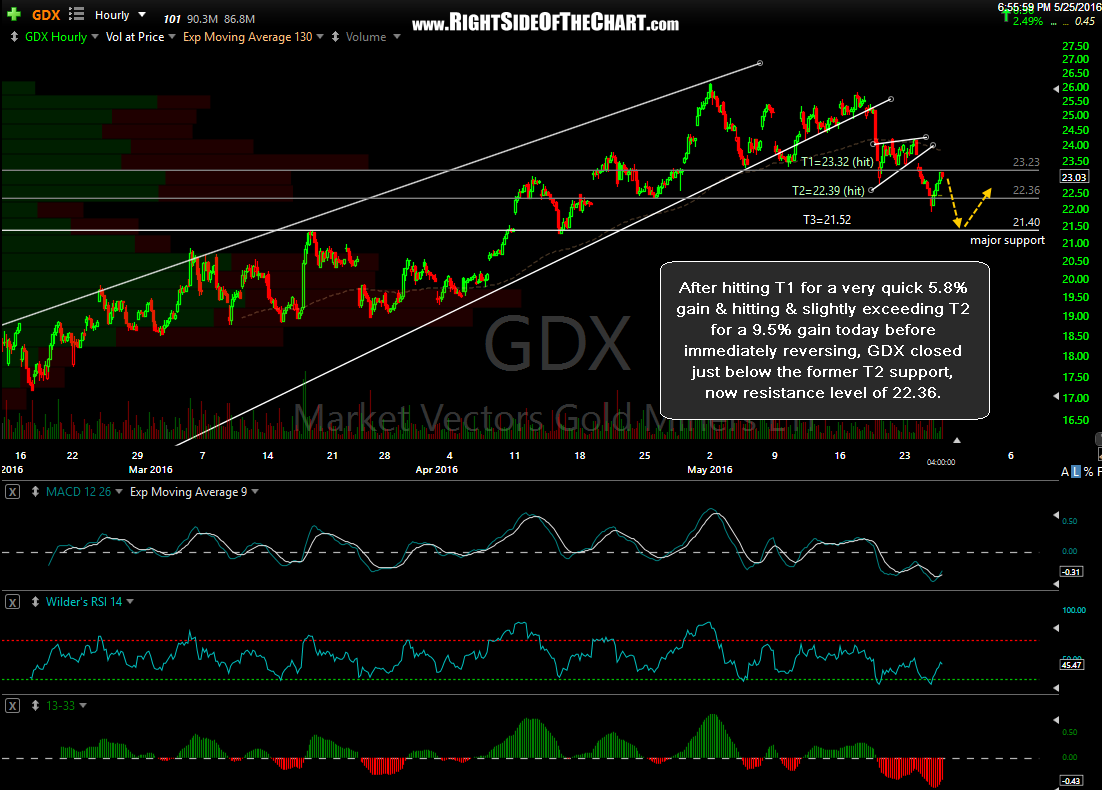

It appears that the GDX/gold stock traders are anticipating a reversal in gold off or near that 116 level as the miners were able to mount a decent reversal after opening lower & falling about 2.28% before reversing & closing up 2.49% for the day although as impressive as that sounds, it was really no more than a typical daily trading range for GDX. After hitting T1 for a very quick 5.8% gain on May 19th (or 3x that for a NUGT short), going on to hit & slightly exceed T2 for a 9.5% gain (or 3x) today before immediately reversing, GDX closed just below the former T1 support, now resistance level of 23.23. For now I’m leaving T3 (21.52) as the final target for the official trade as I still believe there is a decent chance that GDX will hit that level before the current correction has fully run its course.