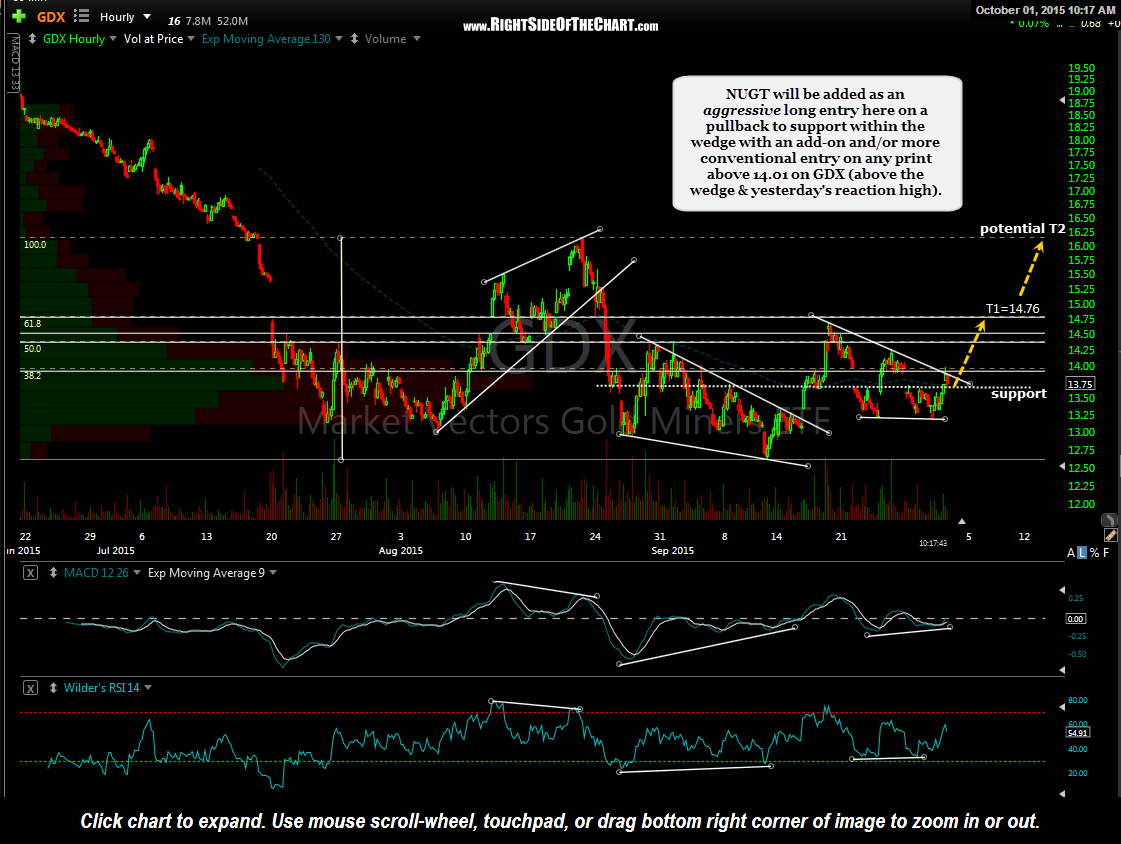

NUGT (3x long gold miners ETF) will be added as an aggressive long entry here on a pullback to support within the wedge with an add-on and/or more conventional entry on any print above 14.01 on GDX (above the wedge & yesterday’s reaction high). The sole price target at this time will correlate to any print of 14.76 on GDX (I prefer to use the GDX chart when trading the leverage ETFs) and I may likely add an additional price target around the 16.20 level on GDX. The suggest stop for an entry here around the 13.75 level would be any move below 13.50 (an attractive 4:1 R/R) with a suggested stop below 13.74 for the alternative entry price of 14.01.

Once again, going long inside a chart pattern, especially just below resistance should be consider an aggressive trading strategy, as I am anticipating a breakout that has not occurred or may not even occur. My plan is to establish a 50% position, taking NUGT to a full position on the alternative entry of any print of 14.01 (on GDX).

Although I can not provide investment or trading advice, I will say that my preference is to beta-adjust my position size accordingly when trading the extremely volatile mining stocks & especially when using leveraged ETFs.