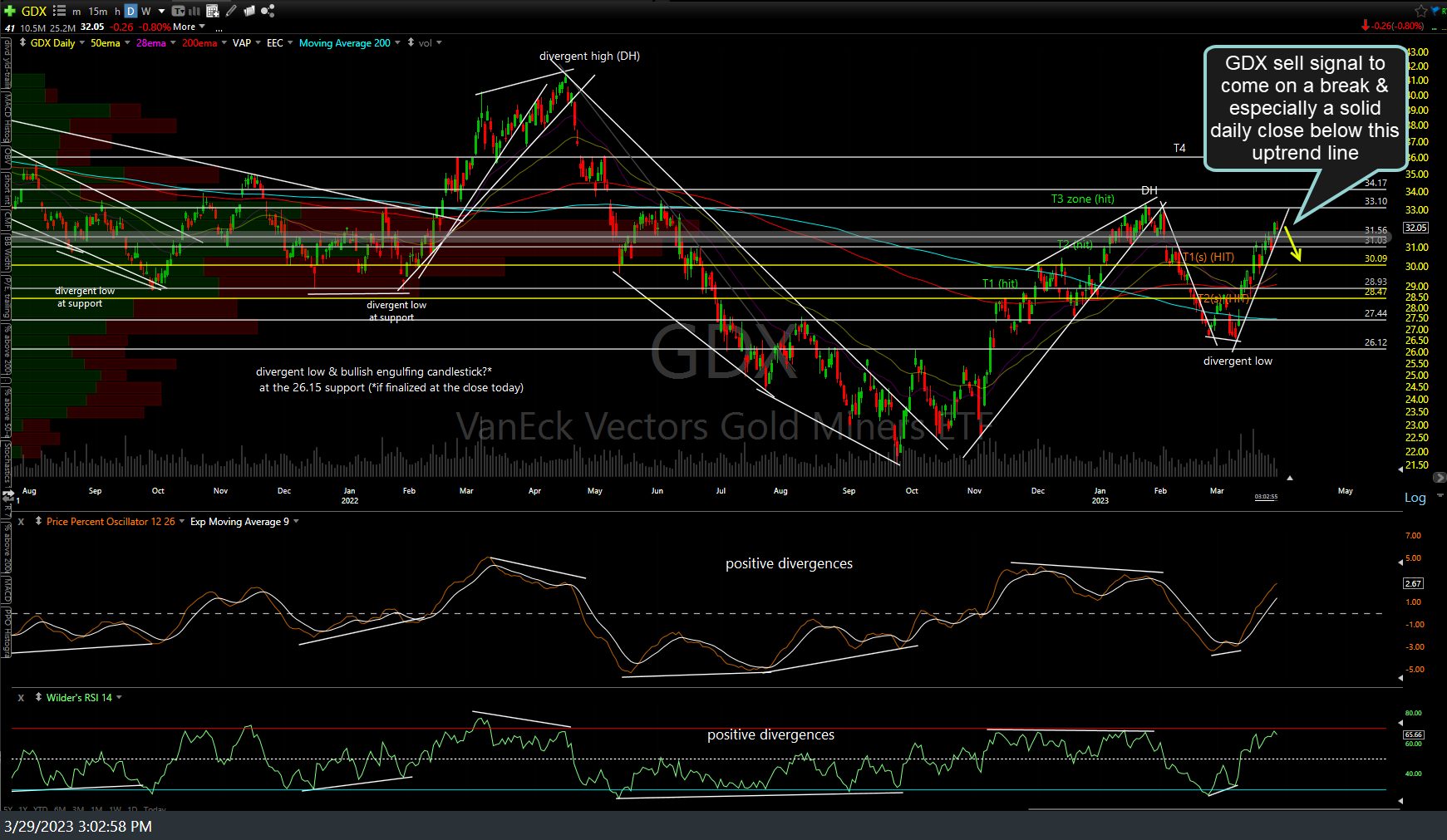

GDX (gold miners ETF) will trigger a sell signal on solid break below this 60-minute bearish rising wedge pattern and/or* on a solid daily close below that same uptrend line on the daily chart. *Waiting for a daily close below the trendline will increase the chance that the breakdown will stick while providing a less-favorable entry price than shorting a break below the 60-minute uptrend line.

GLD (gold ETF) recently put in a divergent high on the 60-minute time frame with ‘potential’ negative divergences building on the daily chart with those divergences to be ‘confirm’ if & when the PPO makes a bearish crossover to put in a lower high (below the previous reaction high). 60-minute & daily charts below.