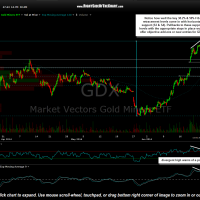

The first chart below is the 60 minute chart of GDX posted yesterday in which I listed my pullback targets. As GDX was still solidly entrenched in an uptrend at the time, I had placed the top of Fibonacci retracement at the top prices at that time, figuring that a near-term top wasn’t far away. As such, the key retracement levels that I am currently targeting, the 38.2% & 50% levels, came in just below horizontal support levels on that chart. Following the marginal new highs put in following today’s gap higher in GDX, I have adjusted the Fibs to reflect what I now feel more confident to be the near-term top in the gold miners that I was looking for and as you can see in the second chart below, today’s updated 60 minute GDX chart, those key Fib retracement levels of 38.25 & 50% now come in right at horizontal support levels, something that I look for to provide additional validation for a support level and/or price target. The third chart is a daily chart of GDXJ (Junior Gold Miners ETF) with some likely pullback targets, the first of which being Thursday’s gap which triggered the impulsive breakout above the primary downtrend just as with GDX, GLD, $GOLD, etc…

- GDX 60 minute June 23rd

- GDX 60 minute June 24th

- GDXJ daily June 24th

I wish that I could say that I had a strong preference for which support level is likely to be the final one hit, assuming of course that I’m even correct about a short-term top being put in place at this morning’s highs. I will say that I am leaning towards a pullback to the S3 level on GDX, which comes in around 24.80, but I wouldn’t be surprised to see GDX find support & go on to make new highs from any of these levels. Should GDX continue lower to find support at only the first or second support levels (S1 or S2) before moving sharply higher, that would indicate a very strong bid underneath the mining stocks and bode well for the intermediate outlook for the sector. As usually, my plan will be to gradually & systematically add back the exposure to the mining sector that I recently reduced as my profit targets were hit over the last week, focusing on the technicals of both the sectors (GDX, SIL, GDXJ, etc…), the metals (GLD, SLV, $GOLD, etc..) and of course, any specific individual mining stocks that I plan to trade or recycle back into after booking profits.