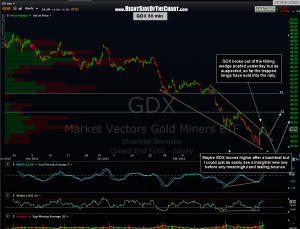

Here’s the update to the 60 minute bullish falling wedge pattern posted yesterday. As you can see, prices broke out of the pattern shortly after posting but have since pulled back. My reasoning for still not adding GDX or some of the individual gold stocks is due to my concern that 1) Too many eyes are now watching the sector, thinking that it has finally bottomed due to that big reversal bar the other day (we all know what happens when too many people think the same thing) and 2) Although it very well may have bottomed, at least for a substantial bounce, I could almost as easily see the sector go on to make a new low. Maybe that happens, maybe not. My trading style is to stack the odds in my favor and since I’d put it at 50/50 that GDX does make a marginal new low, I might either start very gradually scaling into some gold stocks here soon or just stand aside and watch for now. Still undecided but I share the chart for those interested as from a technical perspective (taking away the “what if’s” mentioned above), GDX looks to offer an objective entry at current levels or maybe slightly lower on a backtest of the wedge pattern.

Here’s the update to the 60 minute bullish falling wedge pattern posted yesterday. As you can see, prices broke out of the pattern shortly after posting but have since pulled back. My reasoning for still not adding GDX or some of the individual gold stocks is due to my concern that 1) Too many eyes are now watching the sector, thinking that it has finally bottomed due to that big reversal bar the other day (we all know what happens when too many people think the same thing) and 2) Although it very well may have bottomed, at least for a substantial bounce, I could almost as easily see the sector go on to make a new low. Maybe that happens, maybe not. My trading style is to stack the odds in my favor and since I’d put it at 50/50 that GDX does make a marginal new low, I might either start very gradually scaling into some gold stocks here soon or just stand aside and watch for now. Still undecided but I share the chart for those interested as from a technical perspective (taking away the “what if’s” mentioned above), GDX looks to offer an objective entry at current levels or maybe slightly lower on a backtest of the wedge pattern.

One reason that I am open to the possibility of another low is that often when you see a sector or stock in a period of relentless distribution, as GDX has clearly been in since last Sept/early Oct, you often get a wave or two of selling on the first big rally attempts as the trapped (remorseful) longs who were just praying for the first half-decent bounce to “end the pain” will sell into it once it finally comes. That doesn’t always happen as V-bottoms are know to exist but more often than not, bottoming is a process, not an event. Once again, more nimble or aggressive traders may chose to trade the gold stocks at this point as one thing that is very likely in the near future in this sector will be volatility (which can cut both ways, of course). I plan to post some individual gold stock patterns soon, maybe later today. Good luck if you take these and just remember, gold stocks can be very volatile at times. Consider beta-adjusting your position size accordingly to allow for the larger than usual stop losses and profits targets.